Wendy’s Co. (WEN) came up with a bitter-sweet surprise with its latest 8k filing on April 4, 2022. The company has updated its fiscal 2022 outlook, increased its share buyback program by $150 million, and completed its previous financing round of issuing $500 million in notes.

The company noted that the proceeds from the same would be used for “general corporate purposes, which may include funding for growth initiatives, return of capital to shareholders, and debt retirement.”

Following the news, Wendy’s stock closed up 1.3% at $21.98 on April 4.

Wendy’s is an American quick-service restaurant offering hamburgers and other related fast-food products. Despite persistent supply chain issues, labor challenges and logistics challenges, the company’s shares gained 8.3% over the past year.

Meanwhile, year-to-date, the WEN stock has lost 7.5% pulled down by inflationary pressures and rising input prices for its offerings.

Increases Stock Buyback and Lowers Guidance

In the regulatory filing, Wendy’s noted that its board of directors has authorized an increase to its existing share buyback program to $250 million, due to expire in February 2023.

Additionally, Wendy’s reduced its full-year fiscal 2022 adjusted earnings guidance to fall between $0.82 per share and $0.86 per share. The company had earlier forecast for the same to be in the range of $0.87 to $0.91 per share.

Moreover, the company is also reducing its cash flow from operations forecast to fall between $305 million and $325 million (from $320 million to $340 million). Similarly, free cash flows are now forecast to be between $214-$225 million, lower than the previous guide of $230-$240 million.

On the brighter side, Wendy’s maintained global systemwide sales growth to be between 6% to 8%.

Analyst View Post Update

Following Wendy’s update, Stifel Nicolaus analyst Chris O`Cull made minor tidbits to the model, reflecting the updated guidance but maintained a Hold rating and a $25 (13.7% upside potential) price target on the WEN stock.

The analyst expects further clarification of the usage of proceeds from the debt issuance in the Q1 earnings release, or in its upcoming Investor Day on June 9.

The other analysts on the Street have a cautiously optimistic view of the stock, with a Moderate Buy consensus rating based on eight Buys, five Holds, and one Sell. The average Wendy’s price forecast of $26.81 implies 24.93% upside potential to current levels.

Stock Investors

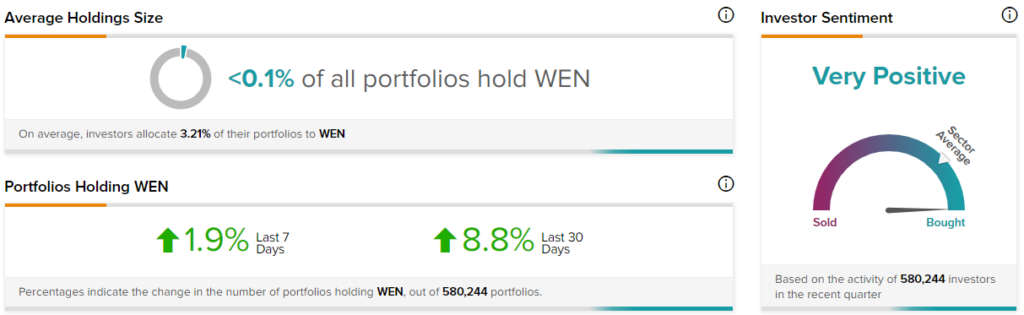

Notably, TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Wendy’s, with 8.8% of portfolios tracked by TipRanks, increasing their exposure to WEN stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Tesla Posts Upbeat Q1 Deliveries, On Track to Deliver 1M EVs in 2022

Why did SNAP Gain More Than 7% on Friday?

UPS Pushes Towards Carbon-Free Fleet