U.S. stocks were mixed on Friday and the S&P 500 logged a fractional gain last week. Information Technology names led the way higher, while the Energy sector lagged.

In economic action, the July employment data surprised to the upside on Friday. The U.S. added 528,000 non-farm payrolls last month, more than doubling expectations, as the headline unemployment rate fell to 3.5%.

Average hourly earnings showed a 5.2% increase from a year ago, deepening the case for rising inflationary pressures. As a result, Fed funds futures are now pricing in a 68% probability that the FOMC will again raise interest rates by 75 basis-points in September.

Elsewhere, the Institute for Supply Management (ISM) posted solid July manufacturing data on Monday. On the other hand, ISM posted a reading below 50 for the services sector on Wednesday, suggesting an economic contraction.

The Week Ahead

The pace of earnings reports winds down next week, with just 23 companies in the S&P 500 scheduled to post quarterly results. American International (AIG) and Walt Disney (DIS) headline the reporting calendar.

Aggregate S&P 500 profit is projected to grow 9.2% in the second quarter, or actually show a 1.5% decline, excluding the Energy sector. Financial names are expected to post the largest earnings drop in the period.

On the economic front, inflation will be back in focus. Consumer prices (CPI) are expected to show 6.1% core growth on Wednesday, excluding food and energy.

Core producer prices (PPI) will come out a day later and are projected to increase 7.7%. Friday’s preliminary Univ. of Michigan consumer sentiment survey also contains a key inflation component.

Given a slowing growth outlook and the prospect of higher interest rates, it could become hard to come by investment gains in 2022. As a result, deciding what and when to buy can be challenging for any investor.

However, the fact remains that investments with upside potential and other positive signals are out there if you dig a little deeper.

One such Industrial name is worth a closer look and is our Stock of the Week.

Stock of the Week: Parker Hannifin (PH)

The company manufactures motion and control systems, selling to the mobile, industrial and aerospace markets.

The stock gained fractionally last week and is showing signs that it has the potential to continue this relative outperformance into the final months of 2022. Here’s why:

Parker Hannifin delivered better-than-expected quarterly results on Thursday. The company earned $5.16 a share in the June quarter, as revenue increased 6% from the previous year to $4.19 billion.

Management said that organic sales grew 10% in the period and that adjusted operating margin reached record levels.

The stock is attractively valued at just 15.8x expected earnings over the next four quarters. This represents a discount to the industry, as well as the broader market.

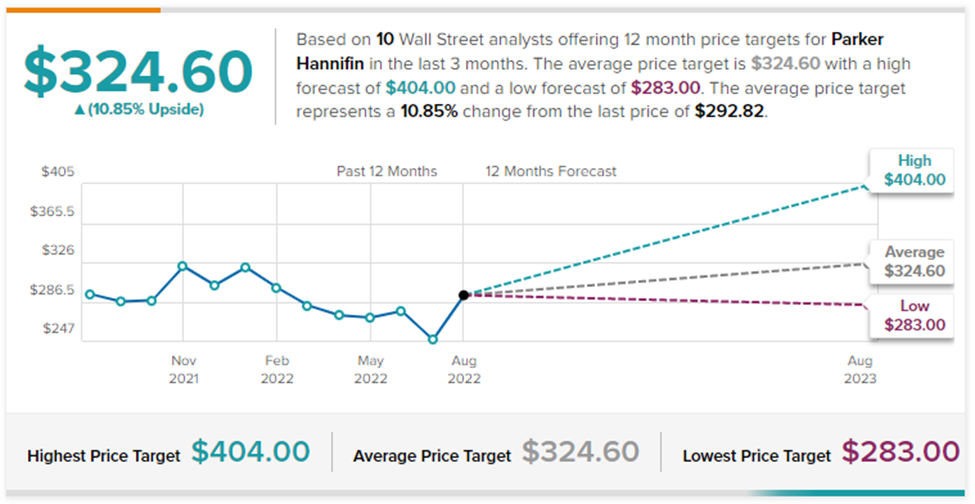

Wall Street agrees that Parker Hannifin is attractively valued. The average price target of 10 active analysts tracked by TipRanks is $324.60, representing 10.9% upside potential.

In the meantime, the company carries an “Outperform” Smart Score of 10/10 on TipRanks. This data-driven stock score is based on 8 key market factors.

On top of the positive aspects mentioned already, the Smart Score indicates that shares have seen insider buying, in addition to improving sentiment from hedge funds and financial bloggers.

FYI: This is just 1 of the 20+ stocks selected for the Smart Investor portfolio, a weekly newsletter that blends big data, and market insights.