The ongoing sales battle for control of entertainment giant Warner Bros. Discovery (WBD) is heating up, as multiple players are starting to get involved to varying degrees. We just heard earlier today that Netflix (NFLX) is getting a bid together, and we have heard that Paramount Skydance (PSKY) has filed multiple bids. That is enough to start the bidding war that David Zaslav was looking for, and investors were very pleased. Shares surged up over 4% in the closing minutes of Friday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Just days ago, David Zaslav hosted a “town hall meeting” for employees, and made it clear that someone was going to have to open the wallet in a very big way to get Warner to sell off. That might not have been Zaslav in particular saying that, but Zaslav did say that the board of directors would be demanding a higher price to sell out.

After all, Zaslav pointed out, Warner already rejected three different bids from Paramount Skydance. It is clearly not afraid to say no. And even if Warner does not hear a bid sufficient to make itself sell out, Warner still has a plan going forward with the splitting off into Warner Bros and Discovery Global, still on tap to happen next year.

Growing Concern

Meanwhile, there is a growing concern within Warner that they might actually get that offer in question. The one that actually makes the board ready to sit up and sign papers. New reports from insiders are an odd mix of terror and bemusement as the rank-and-file is basically waiting for the axe to drop.

While “business-as-usual” memos fly around, employees are reportedly discussing who will actually beat the hangman and come out on the other side of any deal. But overall, Warner staff right now remembers that it has been through these kinds of things before, and likely will see them again. One report noted, “The company has been flipped and flopped so many times that everyone is just like, ‘We’ll see what happens.’ Everyone just has their head down.

Is WBD Stock a Good Buy?

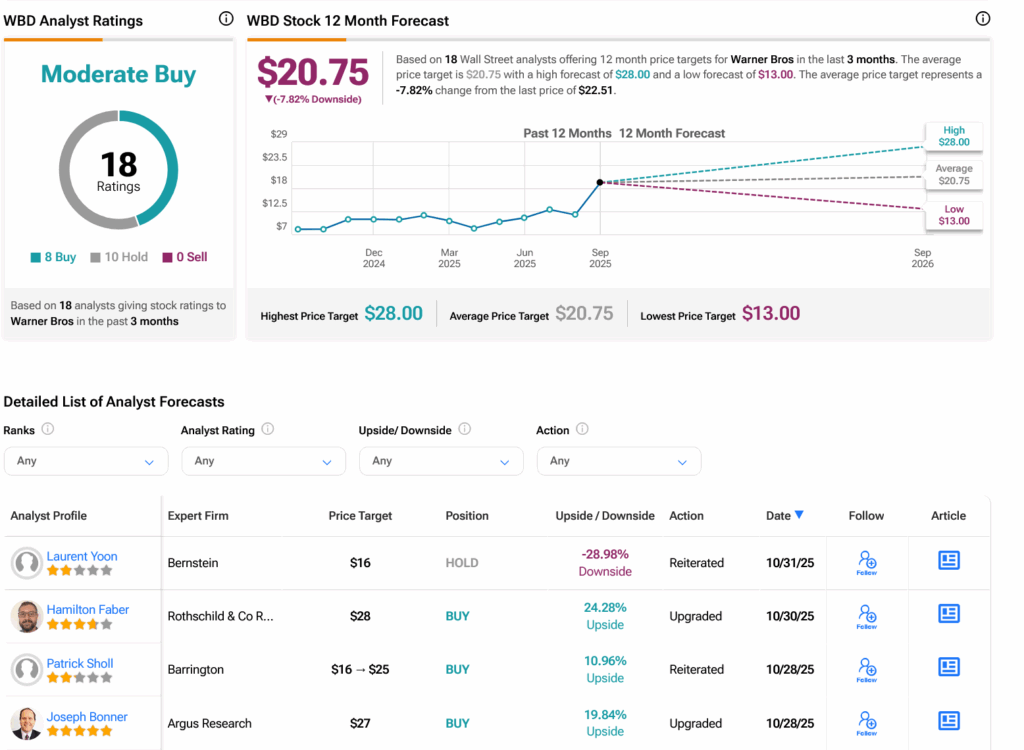

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on eight Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 162.7% rally in its share price over the past year, the average WBD price target of $20.75 per share implies 7.82% downside risk.