So we know that the ongoing sales battle over who is going to walk away with entertainment giant Warner Bros. Discovery (WBD) is still going, and with an unexpected surprise. It is a matter of leadership, apparently, and David Ellison may be in for a demotion sooner than he expects. If Paramount Skydance (PSKY) wins the upcoming bidding war, Ellison may vacate the top slot and let David Zaslav carry on, leading the combined company. The news proved solid enough for investors, as shares rose nearly 1.5% in the closing minutes of Thursday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

There is a new offer on the table for Warner from Paramount Skydance: $58 billion in cash and stock. And, should he decide to stay, David Zaslav would take over the top slot of the combined operation. This is likely welcome news for Zaslav, who has been eager to prove that he could turn Warner around after three years of hard times and cost cutting.

The board, meanwhile, is backing Zaslav, as all offers from Paramount so far have been passed over, and plans to split the company into two parts—Warner Bros., for the studio and streaming arms, and Discovery Global for the linear television components. But the sheer amount of content Warner controls, along with the studio and distribution arms, makes it a highly valuable prize for virtually any media operation.

Paramount’s Plans

Reports also emerged about what Paramount has in mind for Warner, should it take over. Interestingly, reports note, Paramount wants to keep “…most of Warner Bros. Discovery intact if an acquisition happens.” This is something of a surprise, as it is likely to make an acquisition much tougher to get past regulators. The plans even include the possibility of having CNN share resources with CBS News.

That makes for a much more dangerous proposition as far as regulation will go. The Trump administration famously took Paramount to task back when it was merely Paramount over its handling of news. The idea that Paramount would be allowed to buy another news organization, particularly one the size of CNN, is staggering. It also seems like the kind of thing several regulatory groups would land on with both feet. Already, the Writers Guild of America has announced plans to fight such a merger, should it go through.

Is WBD Stock a Good Buy?

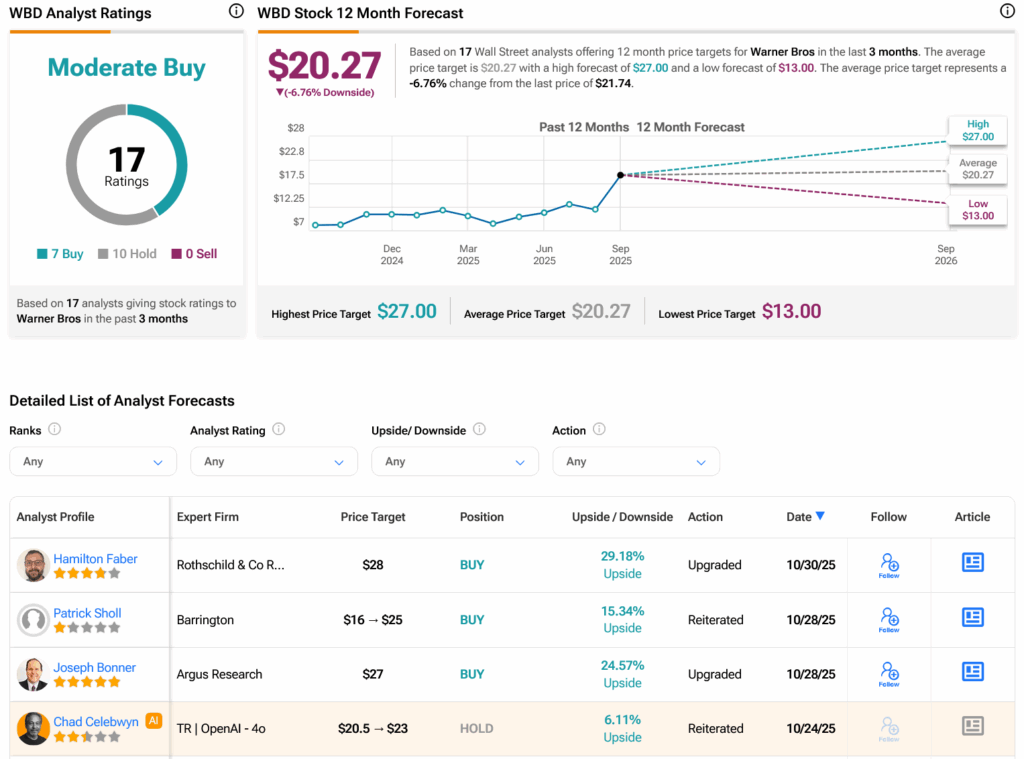

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on seven Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 162.48% rally in its share price over the past year, the average WBD price target of $20.27 per share implies 6.76% downside risk.