This is a problem that has not been brought up much, so it is a good time to do so. While most of us are watching to see who else will make a bid for control of entertainment giant Warner Bros. Discovery (WBD), one point is actually hanging in the balance: director James Gunn’s career. The man who arguably had the most impact on the DC Universe’s turnaround may not be coming along with whoever ends up buying Warner. Investors do not seem worried, though, as shares rose nearly 4% in the closing minutes of Thursday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

So we know that Paramount Skydance (PSKY) has made several moves to buy Warner so far. And we know that Warner has rebuffed the lot so far. But even as we consider who else may be coming in to bid, we also have to consider that the buyer may not get everything it believes it will. A recent interview on the BobaTalks YouTube channel asked Gunn if the outstanding plot threads set up in the recently-released Peacemaker season 2 and the upcoming Lanterns series would run until 2027, when Man of Tomorrow comes out.

Gunn, meanwhile, gave a disturbing response. “If I s—Yes, they definitely go significantly further than Man of Tomorrow. So, now, whether or not that’ll be me that’s able to fulfill that promise depends on a lot of things in life, but yeah.” That immediately sent a cold chill down Warner observers’ spines. Gunn has done a great deal for DC at Warner. The idea that he might not do likewise for DC somewhere else is a point that many likely did not consider. Granted, Warner’s film library is a lot more than just DC, but DC without Gunn seems like it will end up a lot weaker overall.

New Price Tag?

Meanwhile, those considering a Warner purchase had better bring their A-game, and their checkbooks. New reports suggest that Warner is currently valued somewhere around the $45 billion mark, and an attempted sale may ultimately send that figure up still further.

With connections to a wide array of industries from theatrically-distributed movies to streaming properties to gaming and beyond, Warner is involved in media all throughout the spectrum. The question, though, is how much of it will anyone want to buy, and what will Warner actually be willing to sell. We will likely find answers the farther along we go, but considering the minefield of ancillary issues surrounding such a sale, it will almost certainly not wrap up by the end of this year.

Is WBD Stock a Good Buy?

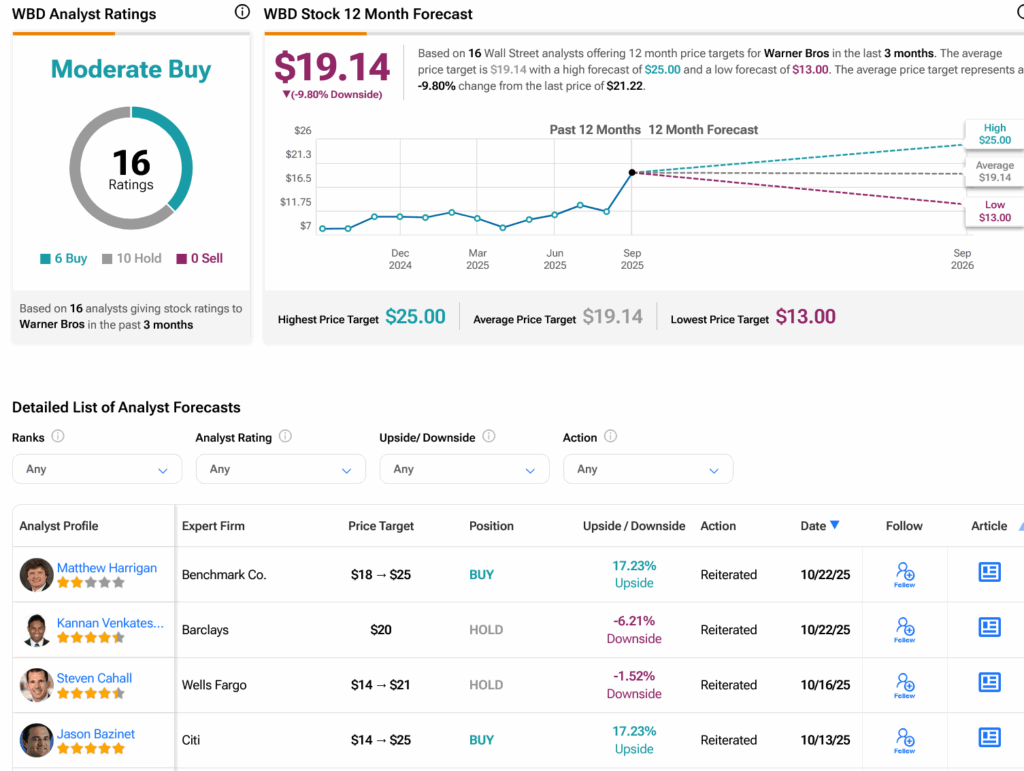

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on six Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 173.01% rally in its share price over the past year, the average WBD price target of $19.14 per share implies 9.8% downside risk.