Follow the crowd, they say. Perhaps not the best advice when queuing hours outside a store or at a packed beach where you only have space to poke one toe in the glistening blue sea.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Going With the Crowd

But what about investing in stocks? Can the power of the crowd tempt you into buying into a stock for the first time or sending you the signals that now might be a good time to exit?

Investors can use their own judgement about the wisdom or the ‘What the …’ of the crowd through the TipRanks tool we creatively call ‘Crowd Wisdom’.

We last looked at the Crowd Wisdom of U.S. retail chain Walmart (WMT) back in the summer. Now as the leaves turn color and cardigans emerge from the wardrobe what, if anything, has changed?

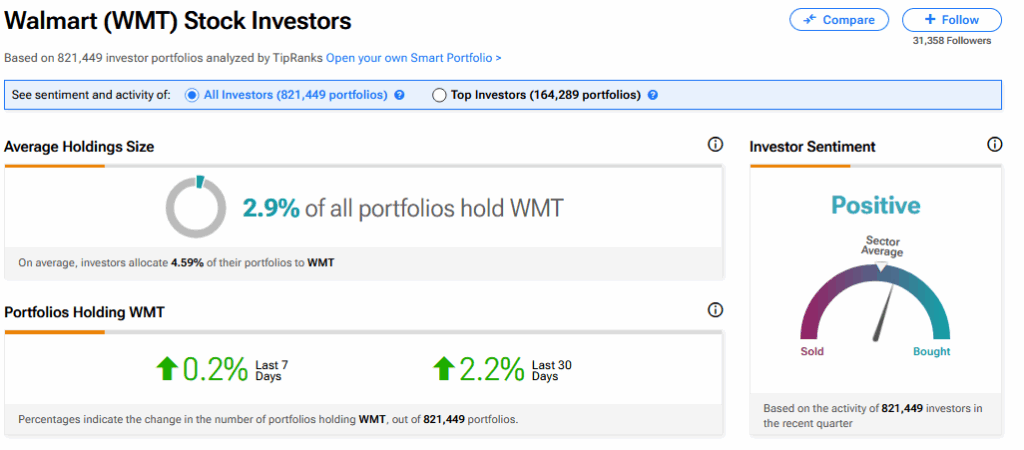

Back in July, we found that 2.7% of all 809,883 investor portfolios analyzed by TipRanks hold WMT stock. Over the last 30 days, 3.1% fewer portfolios held WMT stock and overall investor sentiment was very negative.

Remember this was a period when tariff fears were at their highest and Walmart was getting into a war of words with President Trump over the need to raise prices as a result.

Round of Applause

Let’s find out what has changed as of October 6, 2025.

Looking at the Crowd Wisdom page, we see that 2.9% of 821,449 investor portfolios analyzed by TipRanks now hold WMT stock. Over the last 30 days 2.2% more portfolios held WMT stock, with a 0.2% increase in the last 7 days.

During that period, we’ve seen a huge increase in announcements from Walmart about its AI growth. That includes a partnership with ChatGPT maker OpenAI and an expansion into cryptocurrencies through its OnePay venture.

In addition, since our last Crowd Wisdom visit, Walmart has reported strong Q2 top-line results, with global sales increasing by 5.6% in constant currency. E-commerce sales grew by 25% globally, and Walmart US and Sam’s Club US led with 26% growth, driven by faster delivery speeds. International sales rose by 10.5%, with China, Walmex, and Flipkart contributing significantly.

Favorite Stocks

As such, investor sentiment is now described as being positive and above the sector average. Some of the most optimistic have been people aged under 35, with a 15% increase in WMT holders in the last 30 days. This age bracket represents a fifth of all WMT investors.

Those aged between 35 and 55 drove a 1.3% hike. They represent nearly 44% of all WMT investors.

TipRanks data also shows what WMT investors bought over the last 7 and 30 days. Top of the list was pharmaceuticals group Johnson & Johnson (JNJ), consumer goods giant Procter & Gamble (PG) and industry giant Caterpillar (CAT) being added to portfolios.

Is WMT a Good Stock to Buy Now?

On TipRanks, WMT has a Strong Buy consensus based on 29 Buy ratings. Its highest price target is $129. WMT stock’s consensus price target is $114.89, implying a 12.56% upside.