Upstart Holdings, Inc. (UPST) ended the year with an outstanding fourth quarter, significantly exceeding both earnings and revenue expectations. The company recorded triple-digit growth across all of its key metrics for both Q4 and full-year fiscal 2021. Upstart also gave upbeat guidance for both Q1FY22 and full-year fiscal 2022.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Shares soared 23.1% during the extended trading session, after registering gains of 4.3% on February 15 in anticipation of upbeat results.

Upstart is an artificial intelligence-based (AI-based) lending platform that partners with banks and credit unions to provide affordable credit for every race, ethnicity, age, and gender.

Upstart’s Transaction Volume advanced 301% to $4.1 billion, with bank partners originating 495,205 loans across its platform in the quarter.

Additionally, Upstart’s Board of Directors approved a share buyback program of up to $400 million.

Phenomenal Results

Notably, Upstart’s Q4 revenue jumped a whopping 252% year-over-year to $304.8 million, and outpaced Street estimates of $262.84 million. The revenue boost came from a 240% growth in total fee revenue to $287 million.

Moreover, Q4 adjusted earnings came in at $0.89 per share, significantly higher than analyst estimates of $0.51 per share.

For full-year fiscal 2021, Upstart’s revenue jumped 264% to $849 million, with total fee revenue increasing 251% to $801 million. FY21 adjusted earnings stood at $2.37 per share.

Co-founder Comments

Delighted with the results, Dave Girouard, Co-founder and CEO of Upstart, said, “With triple-digit growth and record profits, Q4 was an exceptional finish to a breakout year for Upstart. 2021 will be remembered as the year AI lending came to the forefront, kicking off the most impactful transformation of credit in decades.”

Girouard added, “But AI lending isn’t a one-category phenomenon. I’m also happy to report that, with help from an epic push by our team in the last few weeks of the year, auto loan originations on our platform are now ramping quickly and will provide growth opportunities to Upstart for years to come.’

Upbeat Guidance

Based on the current business momentum, Upstart gave upbeat guidance for both Q1FY22 and full-year fiscal 2022.

For Q1FY22, UPST forecasts revenue to fall in the range of $295 million to $305 million, higher than to the consensus estimate of $258 million.

Additionally, for FY22, Upstart has projected revenue of approximately $1.4 billion, again higher than the consensus estimate of $1.2 billion.

Stock Prediction

The UPST stock has a Moderate Buy consensus rating based on 2 Buys and 3 Holds. The Upstart stock prediction of $196.60 implies 80.2% upside potential to current levels. UPST stock has gained 94.8% over the past year.

Stock Investors

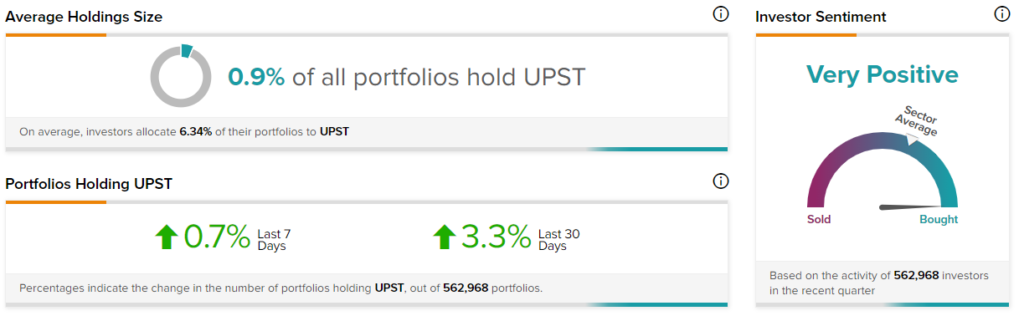

TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Upstart, with 3.3% of portfolios tracked by TipRanks increasing their exposure to UPST stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Intel Nearing $6B Deal to Buy Israel’s Tower Semiconductor – Report

Novavax Shares Plunge 11% Despite Positive Vaccine Update

Ford Continues to Idle Production Amid Chip Shortage – Report