Global chip giant Intel Corp. (INTC) is in advance talks to take over Israel’s Tower Semiconductor Ltd. (TSEM), a manufacturer of integrated circuits, for around $6 billion, according to the Wall Street Journal.

Following the news, INTC stock was up almost 1% during the extended trading session, after ending the day flat at $47.58 on February 14. Meanwhile, following the news, TSEM stock soared 48% during the after-hours trading session.

Tower Semiconductor (TSEM)

Israel-based TSEM is a leading foundry of high-value analog semiconductor solutions. Its chips are used in an array of technologies, from cars to consumer products to medical and industrial equipment.

The company has seven manufacturing plants across the globe, with two plants in Migdal Haemek, Israel; two plants in California and Texas in the U.S.; and three plants in Japan through its partnership with Panasonic Semiconductor Solutions Co. LTD. The company is listed on the NASDAQ in the U.S. and competes with global chip makers like GlobalFoundries Inc. (GFS). TSEM is scheduled to report its Q4 and Fiscal 2021 earnings report on February 17, 2022.

Intel’s Interest in Takeover Valued at $6B

According to sources, Intel’s interest in buying the chip maker stands at $6 billion, representing a huge premium to TSEM’s market cap of $3.65 billion on Monday. If the talks go well, a final deal could be announced as early as this week. Intel has a market cap of $194 billion and its shares have lost 14.6% over the past year.

Intel is looking to expand its manufacturing base with this acquisition. The pandemic triggered global chip shortage is viewed as a favorable environment for chip manufacturers to expand their offerings and capture further market share.

In January, Intel had announced its plans to invest around $20 billion in new chip-making facilities in Ohio, with an intent to meet the growing demand for semiconductors across various sectors and applications. The “mega-site” is expected to host about eight factories, with a total investment expected to grow up to $100 billion over the next decade.

In a strategic move, Intel also plans to list its autonomous self-driving unit, Mobileye at a whopping $50 billion.

Intel Target Price

The Wall Street community has a Hold consensus rating on the INTC stock based on 6 Buys, 9 Holds, and 5 Sells. The average Intel price target of $55.11 implies 15.8% upside potential to current levels.

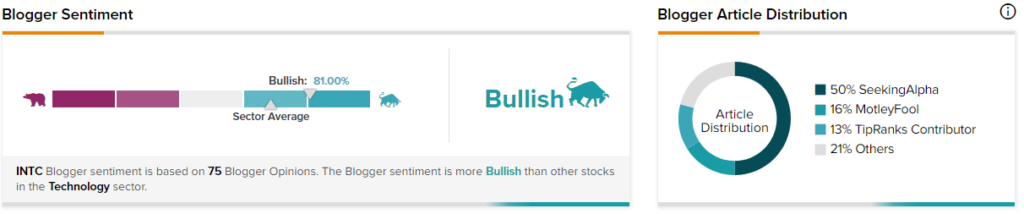

Blogger Opinions

TipRanks data shows that financial blogger opinions are 81% Bullish on INTC, compared to a sector average of 69%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Goodyear Tire Crashes 27% Despite Solid Q4 Beat

Soros Reveals $1B Stake in Rivian – Report

Under Armour Tops Q4 Expectations; Shares Drop 12%