Unity Software (NASDAQ:U) may not be one of the first names most think of in video game stocks, but it is definitely one of the biggest names around. Recently, it unveiled its new AI marketplace and drew the attention of Wells Fargo, which had a lot of good to say about Unity. All of these together were enough to send Unity up over 14% at one point in Tuesday afternoon’s trading.

The Unity Game Engine is typically favored by small studios and mobile operations but has still given us some big-name operations. Games from “Cuphead” and “Subnautica” to “7 Days to Die” and even former phenom “Pokemon Go” all incorporate the Unity engine into their operations. So, when Wells Fargo analyst Brian Fitzgerald started coverage and declared it a Buy with a $48 price target, there was reason enough to take notice.

Fitzgerald noted that, while most have been focused on Unity’s acquisition of ironSource and the metaverse, that same “most” have missed a “meaningful mobile cross-sell opportunity,” along with a slate of “cost synergies” and a larger market to work with. The environment is “still fragmented,” which gives Unity a chance to break out of the shadows of working with smaller groups and becoming a larger part of the gaming landscape. Throw in the newly-developed AI marketplace that will open up more buying opportunities and revenue generation, and the end result could be a real winner for Unity.

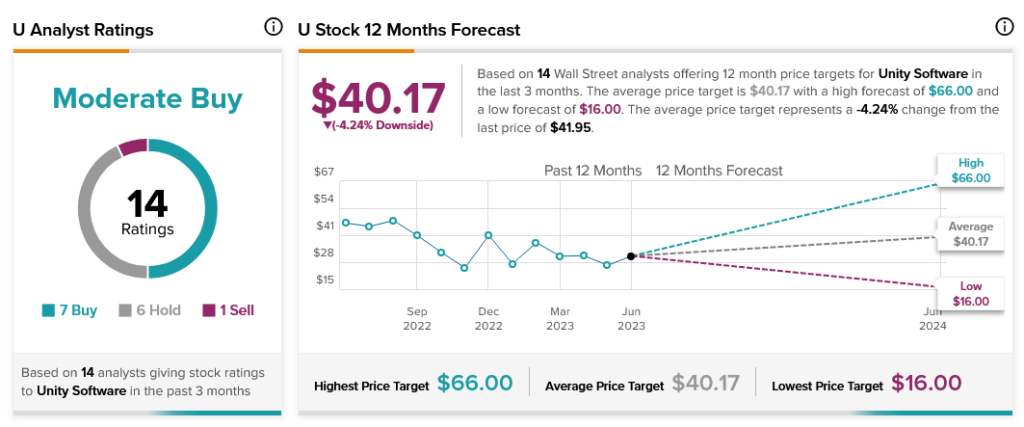

Fitzgerald is hardly alone in his assessment. With seven total Buy ratings, six Holds, and one Sell, Unity stock is considered a Moderate Buy. However, with an average price target of $40.17 per share, Unity stock comes with 4.24% downside risk.