United Airlines finished a turbulent FY20 flipping to a loss of $7.1 billion from a profit of $3 billion a year ago as the pandemic-led lockdown restrictions brought air travel to an almost complete halt.

The US airline called the Covid-19 crisis “the most disruptive crisis in aviation history”. Shares dropped 3.8% in early Thursday trading.

United Airlines’ (UAL) reported a net loss of $1.9 billion in 4Q versus a profit of $641 million in the year-ago period. Its 4Q loss of $7 per share was larger than analysts’ estimates of a loss of $6.60 per share.

Revenues in 4Q plunged 69% year-on-year to $3.4 billion. Looking ahead to 1Q21, the air carrier expects revenue to be down by 65% to 70% year-on-year. In addition, United announced plan to cut operational costs by $2 billion and generate future cost savings.

United’s CEO, Scott Kirby commented, “Aggressively managing the challenges of 2020 depended on our innovation and fast-paced decision making. But, the truth is that COVID-19 has changed United Airlines forever. The passion, teamwork and perseverance that the United team showed in 2020 is exactly what will help us build a new United Airlines that’s better, stronger and more profitable than ever.”

United had $19.7 billion in liquidity (cash and cash equivalents) available at the end of FY20. This includes $1 billion in an undrawn revolver credit facility and funds of $7 billion that are available under the CARES Act loan program from the US Treasury. (See UAL stock analysis on TipRanks)

The airline expects its liquidity position at the end of 1Q21 to be little changed from the level at the end of FY20. United believes FY21 could be a “transition year” and is hopeful that operational cost reductions and timely maintenance of its airline fleet will help the company exceed its 2019 adjusted EBITDA margin of 16% by 2023.

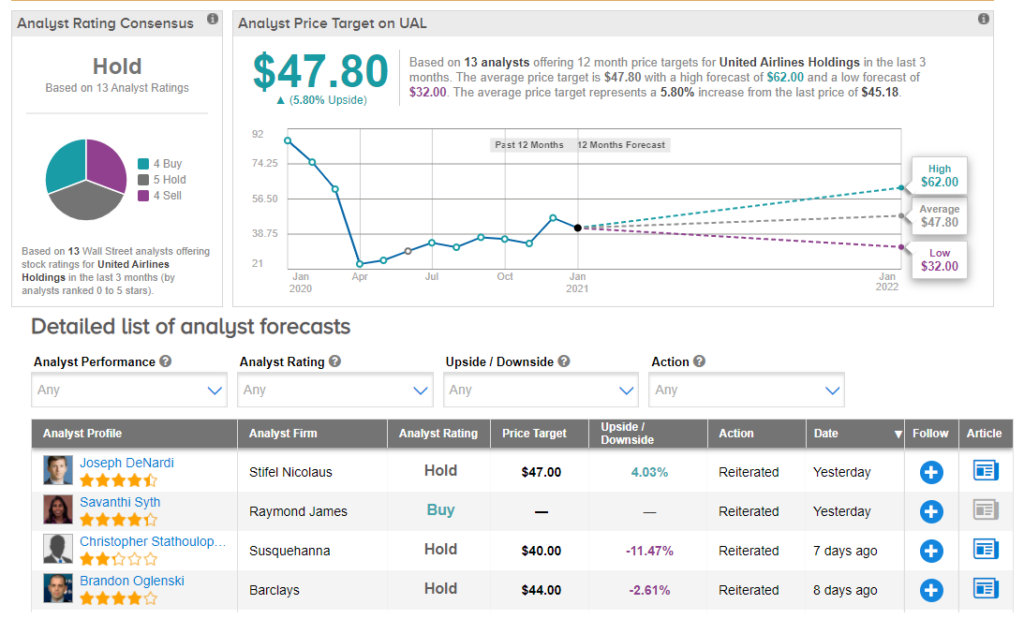

Following the 4Q results, Raymond James analyst Savanthi Syth reiterated a Buy rating on the stock. Syth commented, “We believe United’s 4Q20 report is largely in line with expectations with the 1Q21 outlook reflecting a continuation of current trends, consistent with Delta’s view (except that United’s revenue guide does not assume peak periods will continue to outperform off-peaks).”

The analyst added, “Despite near term uncertainty, United did provide a goal post for earnings recovery, targeting annual structural cost savings of at least $2B ($1.4B identified), or ~7% of 2019 non-fuel OpEx (5% identified), leading to a 2023 EBITDA margin exceeding the 16% achieved in 2019.”

Overall, Wall Street analysts are sidelined the stock. The consensus is a Hold with 4 analysts suggesting a Buy, 5 analysts recommending a Hold, and 4 analysts have a Sell. Meanwhile, the average price target of $47.80 implies 5.8% upside potential to current levels.

Related News:

ViacomCBS To Launch Paramount+ Streaming Service In US In March

MGM Resorts Walks Away From Takeover Bid For Entain

MasterCraft Is Going Digital For Its Dynamic Boat Show Season