A couple notes of relief may be coming out for Uber (NASDAQ:UBER), as the ridesharing and delivery giant gained over 2% in Wednesday afternoon’s trading thanks to some legal issues that look less serious than initially anticipated.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The first bit of good news came out of Minnesota, where Tim Walz will sign a new law that will keep Uber providing service to the Twin Cities, along with its contemporary and immediate competitor Lyft (NASDAQ:LYFT). The law establishes compensation rates for ride-hailing operations throughout Minnesota and basically gives the drivers of these services a 20% pay hike.

Originally, the Minneapolis City Council tried to establish pay rates for drivers, but after both Uber and Lyft threatened to pull out of Minneapolis-St. Paul (the part that makes the pair the “Twin Cities”), Walz got involved and moved to set rates for the entire state that would actually keep Uber and Lyft offering service. But a similar effort in California may be hitting some snags, as the state Supreme Court considers Prop 22, which addressed the AB5 independent contractor law.

A Surprisingly Low-Wage Position

This news comes right on the heels of a distressing new study, revealing that Uber and Lyft drivers—as well as DoorDash (NASDAQ:DASH) drivers—are shockingly low-paid. In fact, even with tips, a UC Berkeley study found that many gig drivers aren’t even making minimum wage. This is based on results from the Gridwise app and 1,088 drivers, which found that by the time drivers cover their expenses, like gas and insurance, they’re not even making federally mandated minimums for pay. Delivery drivers in California, with tips, made an average of $13.62 per hour, while in other states, that number dropped to $9.87.

Is Uber a Buy or Sell Right Now?

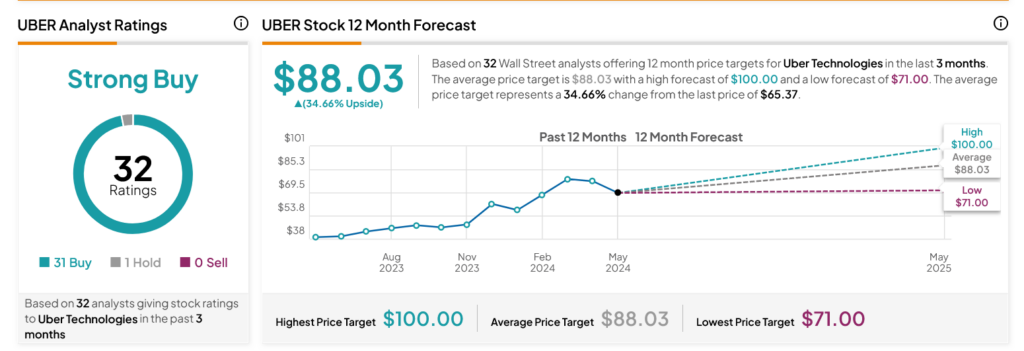

Turning to Wall Street, analysts have a Strong Buy consensus rating on UBER stock based on 31 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 69.71% rally in its share price over the past year, the average UBER price target of $88.03 per share implies 34.66% upside potential.

Is It Wise to Allocate $1,000 Toward UBER Stock Right Now?

Before you hurry to invest in UBER, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and Uber is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead.

Discover Top Picks ➜