Talks between the United States and China in Kuala Lumpur have brought a new round of optimism to global markets. After two days of meetings, officials said both countries reached a preliminary trade deal that could ease tensions built up over the past few months. The news comes just days before U.S. President Donald Trump and Chinese President Xi Jinping are set to meet at the Asia-Pacific Economic Cooperation summit in South Korea.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A Step Toward Calm

Chinese Vice Premier He Lifeng and U.S. Treasury Secretary Scott Bessent led their teams in discussions that both sides called “constructive.” The talks covered several key issues, including China’s export limits on rare earth materials, U.S. restrictions on tech exports, and new measures to reduce the flow of fentanyl. Both sides also discussed keeping their current trade truce beyond November 10 and lowering extra port fees on each other’s ships.

The deal is still in its early form, but it gives both governments a base to work from. If approved, it could delay or prevent the 145% tariffs that President Trump planned to start on November 1.

Why It Matters for Investors

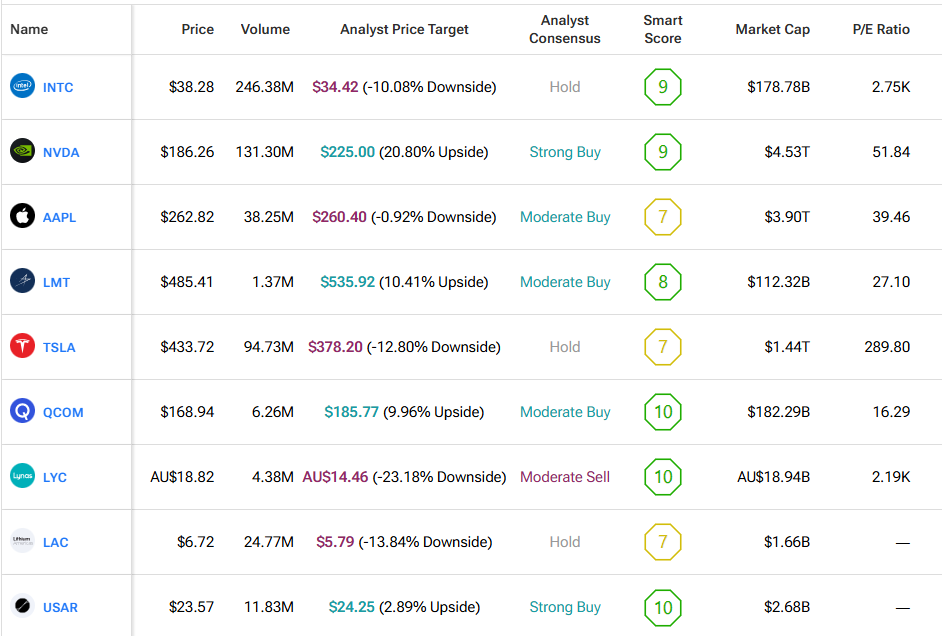

Rare earth materials are critical for electric cars, smartphones, and defense products. China controls about 90% of the global supply. Any move to reopen this trade flow could ease pressure on U.S. tech and auto firms, including Tesla (TSLA) and Apple (AAPL). It could also help defense suppliers like Lockheed Martin (LMT) that rely on stable access to these minerals.

Meanwhile, a pause in tariffs would likely lift investor sentiment. Global markets have reacted sharply to every sign of progress or breakdown between Washington and Beijing. A framework deal, even if partial, could help steady supply chains and bring relief to sectors hit by earlier disruptions.

For now, both sides will prepare documents for their leaders to review. The Trump-Xi summit later this week will decide whether this framework turns into a lasting agreement.

By using TipRanks’ Comparison Tool, we’ve lined up all the companies mentioned in this piece and other notable ones from the mineral and technology sectors to make it easy for investors to review each stock and see how they stack up across the mineral sector.