China’s shipments of rare earth magnets to the U.S. dropped nearly 30% in September compared with last year, marking the second month of decline. The latest data from China’s customs office showed exports of 420.5 tones in September, down almost 29% from August. The fall followed a short rebound earlier in the summer, when Beijing had briefly eased export rules during trade talks in London.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Stricter Rules and Slower Permits

Since September, Chinese firms have faced tighter reviews when applying for export licenses. The stricter checks came just before Beijing widened its export controls on rare earth materials in October. These rules have added new strain to trade ties between Washington and Beijing as both sides try to gain leverage in key industrial sectors.

China controls about 90% of the global supply of rare earth magnets used in electric vehicles, wind turbines, phones, and defense systems. Past restrictions have already caused shortages and delays across global industries, and the latest drop in shipments could put more pressure on companies that rely on a steady supply.

U.S. and Allies Move to Secure Supply

In response, the U.S. and its partners are working to build new sources of critical materials. On Monday, the U.S. and Australia signed a minerals deal worth up to $8.5 billion to fund projects that strengthen rare earth and critical mineral production for defense and energy use.

At the same time, Noveon Magnetics and Lynas Rare Earths (AU:LYC) signed an agreement to create a domestic magnet supply chain in the U.S. However, magnet production remains complex and still depends on rare earth mining and refining, which China continues to dominate.

Currently, only a few U.S. companies make magnets locally, and most are still ramping up early production. Building a steady supply chain will take time and large investment. For now, China’s export controls continue to shape the global flow of materials that power some of the world’s most important technologies.

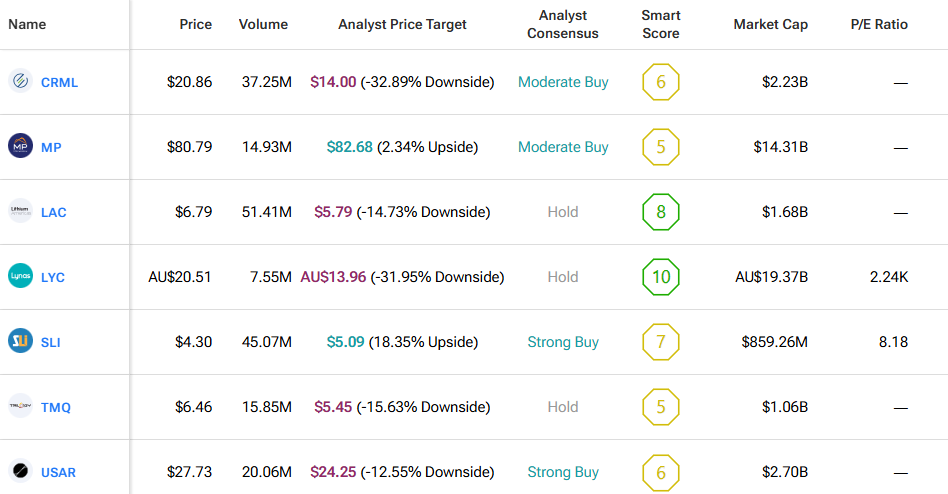

By using TipRanks’ Comparison Tool, we’ve lined up all the companies mentioned in this piece to make it easy for investors to review each stock and see how they stack up across the mineral sector.