The CEO of Capita (GB:CPI), branded ‘the Turnaround King’ has spoken out on his hopes for the company after taking over four years ago amid a collapse in outsourcing in the UK.

Lewis previously oversaw a transformation at Amec Foster Wheeler which led to a £2.2 billion acquisition by John Wood Group (GB:WG).

In a wide-ranging interview with This is Money, the 60-year-old businessman said that Government contractor Capita had previously spent too long racking up debt and paying dividends.

‘Integral to the UK’

He said, ‘Let’s remember this is a business that is integral to the fabric of the UK. That may sound like a grandiose statement, but we engage with 50 per cent of the population of this country in some way or form virtually every week.

‘We, collectively as a board and as a leadership team, have saved the company so that we can continue to do that and do it better than we’ve ever done it before.’

Lewis has positioned Capita as a high-tech firm, moving into artificial intelligence and chatbots and away from traditional call centres. He has also set up a consulting division.

Consulting division

He said that previous to his arrival in 2017, ‘We didn’t manage relationships with our clients in the way that other businesses or Big Four professional services firms might, there were no partners that would own that relationship.’

Lewis says he is optimistic that Capita’s stock will hit the level it was at prior to the company’s £681 million rights issue in 2018 within one to two years, the Mail reported.

But the stock has remained low, currently trading at 25.98p.

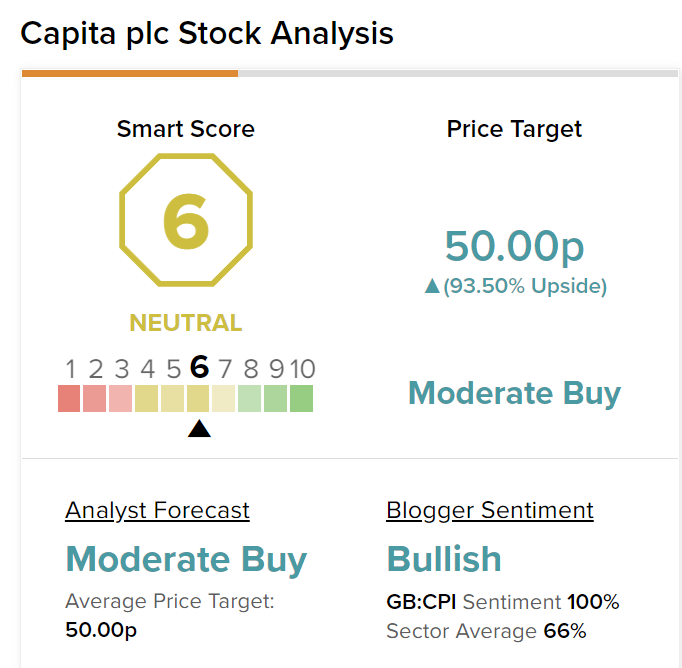

Capita has a Smart Score of six on Tipranks.

View from the City

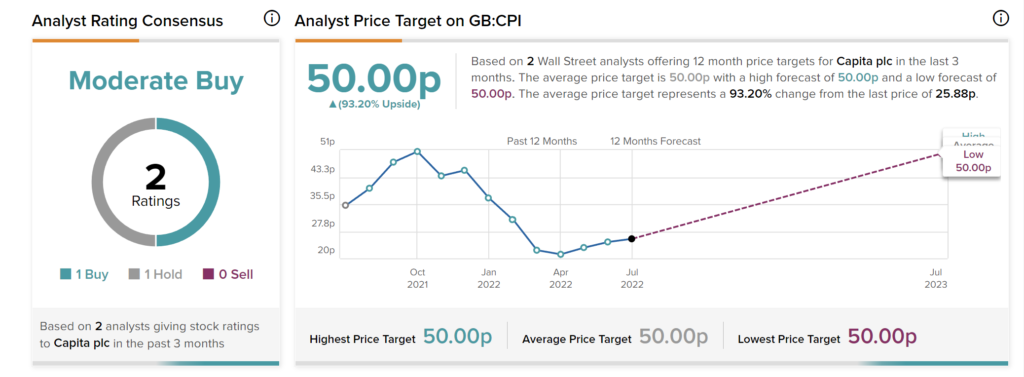

According to TipRanks’ analyst rating consensus, Capita’s stock has a Moderate Buy rating based on one Buy and one Hold from two analysts.

The price target of 50p implies a 92.46% upside potential, according to a ranking by Paul Sullivan of Barclays.

Sullivan has a 60% success rate according to TipRanks, and his ratings have 7.1% average return.

Conclusion

The CEO is optimistic that Capita stock can rebound. Analysts are slightly less bullish, but there is potential here.