The shares of Taiwan Semiconductor Manufacturing Company (TSMC) (TSM) extended gains in early trading on Thursday after Cheng Li-chiun, Taiwan’s Vice Premier, said the island country would not support the Trump administration’s 50:50 chip sourcing policy, according to Reuters. The plan would require U.S. firms to evenly split domestic and imported semiconductor purchases.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cheng made the remark while giving an update on the Taipei government’s trade negotiations with the White House. She noted that the Taiwanese government was looking to establish a high-tech strategic partnership with the U.S. However, the 50:50 policy was not part of the discussion.

TSMC’s shares were up 1.18% to about $292 per share around 6:08 a.m. EDT on Thursday, adding to gains of 3.29% from regular trading the previous day.

U.S. Pushes Taiwan for 50-50 Chip Arrangement

Cheng’s comment comes as Washington puts pressure on Taipei to agree to a 50:50 semiconductor plan, as the U.S. aims to produce a much larger portion of its semiconductor consumption. The U.S. currently maintains a 20% tariff on imports from Taiwan, and the Trump administration has proposed 100% tariffs on semiconductors.

Howard Lutnick, the U.S. Commerce Secretary, noted earlier this week that the goal is for half of the chips sold in America to be made domestically, while the other half will come from Taiwan. Lutnick is aiming to reach 40% of U.S. domestic chip production by the end of Trump’s current term. However, such expanded local production would require over $500 billion in local investment.

The 50:50 plan is part of the Trump administration’s rumoured intention to demand that companies in the semiconductor industry maintain a 1:1 ratio of U.S.-made to imported semiconductors. Such a move is expected to give “some stock boost” to American chipmakers, including Intel (INTC), GlobalFoundries (GFS), Micron (MU), and Texas Instruments (TXN).

Taiwan Commits to Domestic Foothold

According to the Semiconductor Industry Association (SIA), global semiconductor sales are expected to surpass $700 billion by the end of this year, as the market is projected to reach $1 trillion in chip sales by 2030. However, the U.S. only manufactured about 12% of the world’s semiconductors last year.

Currently, Taiwan manufactures more than 90% of the world’s advanced semiconductors, with TSMC leading as the largest chip supplier for U.S. tech giants, including Nvidia (NVDA) and Apple (AAPL).

Speaking on the chip plan, Cheng noted that while the country understands the U.S. goal of ramping up its domestic chip production, Taiwan aims to remain rooted in the country while deploying its technology globally and forming strategic bilateral relationships.

Nonetheless, Taiwan Semi has been deepening its U.S. footprint. The company, which is building manufacturing facilities in Arizona, recently expanded its planned U.S. investments to $165 billion following a new $100 billion pledge made earlier this year.

Is TSM a Buy or Sell?

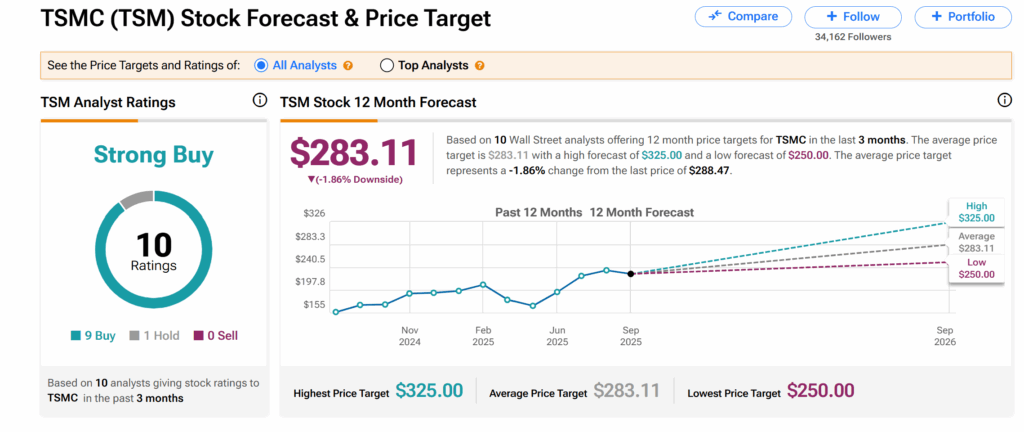

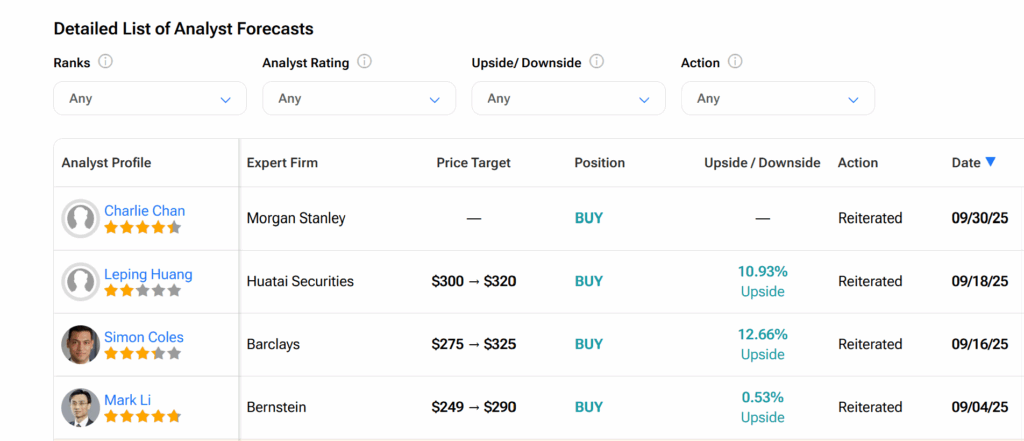

Across Wall Street, TSMC’s shares currently boast a Strong Buy consensus recommendation, as seen on TipRanks. This is based on nine Buys and one Hold assigned by 10 Wall Street analysts over the past three months. However, the average TSM price target of $283.11 indicates nearly 2% of downside risk.