U.S. President Donald Trump is again warning that he will soon impose “fairly substantial” tariffs on semiconductor imports from companies that do not shift production to the U.S.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The threat of tariffs tends to disrupt the stocks of major U.S. microchip and semiconductor companies such as Nvidia (NVDA), Advanced Micro Devices (AMD), and Broadcom (AVGO) that manufacture the majority of their products in Taiwan.

However, President Trump says that his administration will spare some technology firms such as Apple (AAPL) that have grown their investments in America. Trump made the comments during a dinner at the White House with more than two dozen technology leaders, including Apple CEO Tim Cook, Meta Platforms’ (META) Mark Zuckerberg, and Oracle (ORCL) CEO Safra Catz.

Tech Threats

President Trump, who seems to enjoy both attracting and threatening tech and business leaders, said at the dinner, “I’ve discussed it with the people here, chips and semiconductors, and we’ll be putting tariffs on companies that aren’t coming in,” referring to moving manufacturing to the U.S.

“We’ll be putting a tariff very shortly. You probably are hearing we’ll be putting a fairly substantial tariff, or not that high, but a fairly substantial tariff.” Trump said in August that he would impose a 100% tariff on semiconductor imports, while exempting products from companies that move their manufacturing to the U.S. That threatened tariff has yet to materialize.

Is AAPL Stock a Buy?

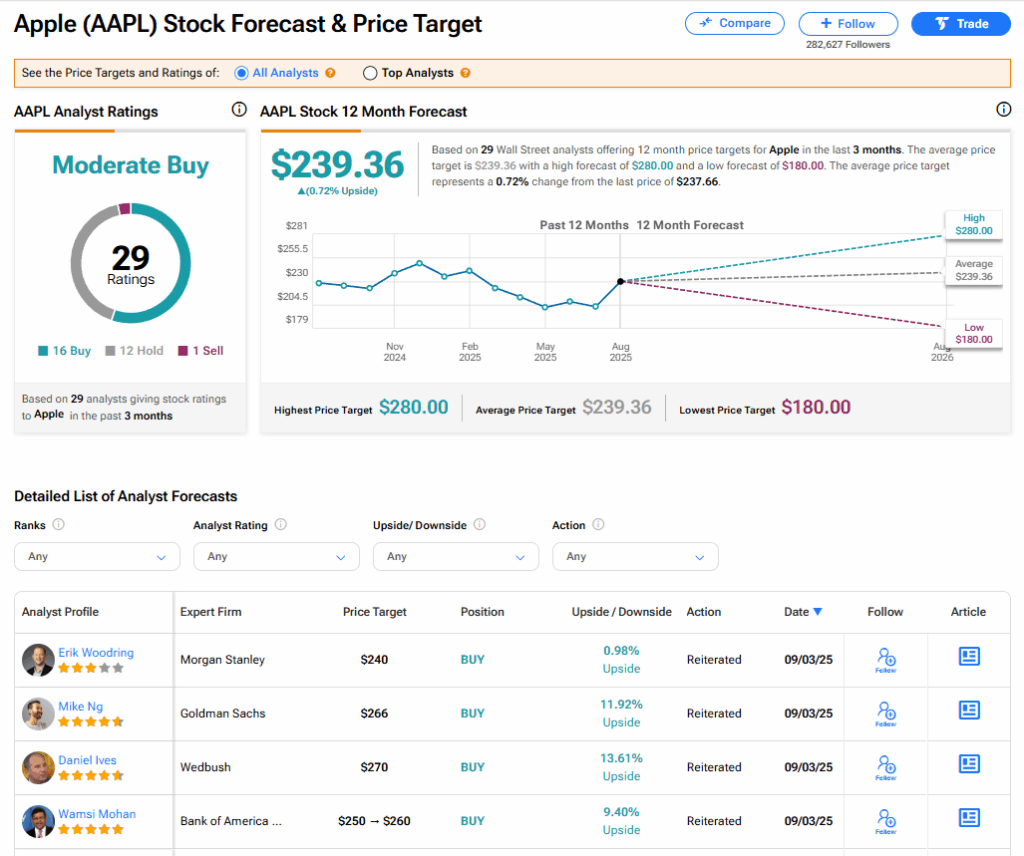

The stock of Apple has a consensus Moderate Buy rating among 29 Wall Street analysts. That rating is based on 16 Buy, 12 Hold, and one Sell recommendations issued in the last three months. The average AAPL price target of $239.36 implies 0.72% upside from current levels.