Analysts at equity research firm MoffettNathanson have upgraded Apple’s (AAPL) stock, saying that the “worst-case scenarios are off the table” for the iPhone maker.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

MoffettNathanson, which had previously been one of the biggest Apple bears on Wall Street, raised its rating on the consumer electronics company’s stock to a Hold-equivalent neutral from Sell previously. The research firm also placed a $225 price target on AAPL stock.

The analyst team at MoffettNathanson wrote that tariff risks and the Alphabet (GOOGL) antitrust case that were previously dragging on AAPL stock now seem to be in the company’s rearview mirror. Previously the brokerage had argued that Apple’s share price did not reflect growing risks to the company, and grumbled that Apple’s artificial intelligence (AI) features had failed to boost iPhone sales.

Bearish No More

MoffettNathanson wrote that U.S. tariffs on goods made in China, such as Apple’s iPhone, have been blunted as the two countries negotiate a trade deal, and the ruling in the Google antitrust case is widely seen as positive for Apple.

Google pays Apple about $20 billion annually to be the default search engine on Apple’s Safari browser and devices such as the iPhone. The judge in the antitrust case ruled that Google parent company Alphabet can continue paying Apple and other companies for default search engine status. Those annual payments are a sizable portion of Apple’s revenue. AAPL stock is down 5% this year.

Is AAPL Stock a Buy?

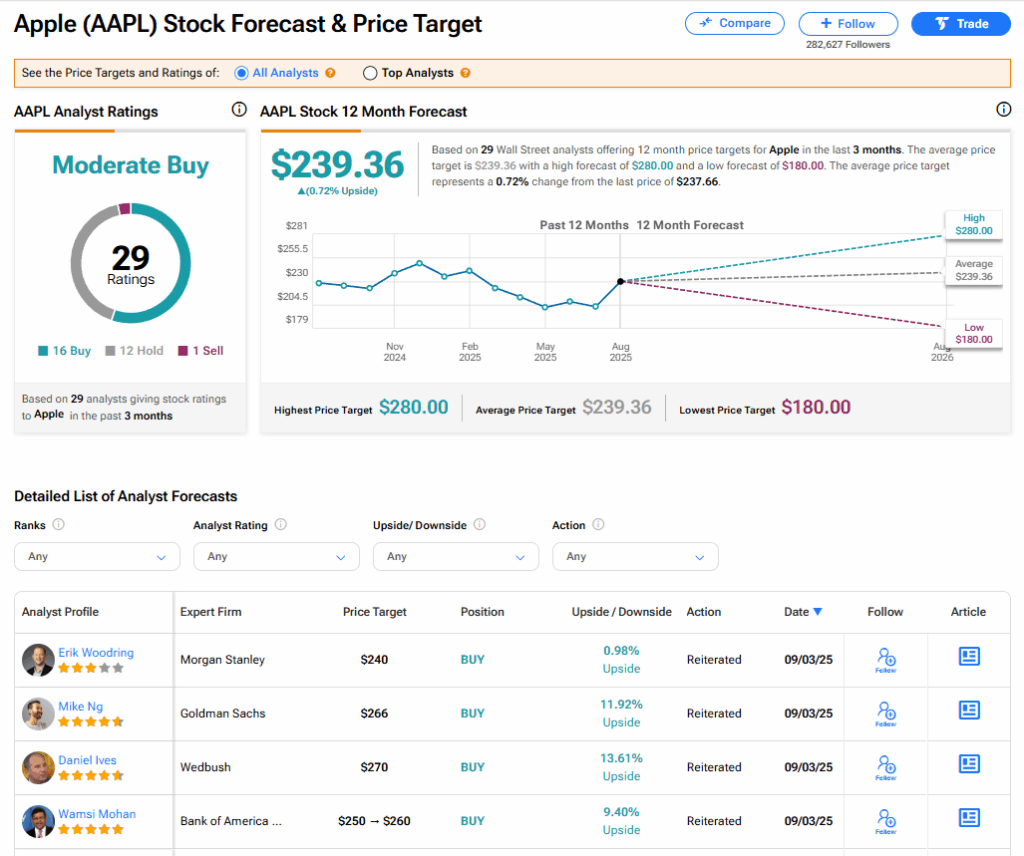

The stock of Apple has a consensus Moderate Buy rating among 29 Wall Street analysts. That rating is based on 16 Buy, 12 Hold, and one Sell recommendations issued in the last three months. The average AAPL price target of $239.36 implies 0.72% upside from current levels.