Washington is pressuring Taipei to agree to a new plan for chip manufacturing. U.S. Commerce Secretary Howard Lutnick stated that the goal is for half of the chips sold in America to be made domestically, and the other half to come from Taiwan. He noted that the United States would still rely on Taiwan, but it would also secure a larger share of its own supply.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In addition, Lutnick said he wants U.S. domestic chip production to reach about 40% by the end of President Donald Trump’s current term. Meeting that target would require more than $500 billion in local investment.

At present, Taiwan produces more than 90% of the world’s advanced semiconductors. The country’s lead comes from Taiwan Semiconductor Manufacturing Company (TSM), which is the largest chip supplier for major U.S. firms, including Nvidia (NVDA) and Apple (AAPL).

Investment, Trade, and Security

The Trump administration has linked this plan to both trade and defense. Last year, Trump said Taiwan should pay more for U.S. military support. Lutnick repeated that Washington expects more in return as it continues to back Taipei against pressure from China.

At the same time, Taiwan Semiconductor Manufacturing Company has been expanding in the United States. The company began building facilities in Arizona in 2020 and has since raised its planned U.S. investment to $165 billion after a new $100 billion pledge earlier this year.

Furthermore, the Trump administration has proposed 100% tariffs on semiconductors. However, companies that invest in the United States would be exempt. Washington and Taipei remain in trade talks, and those talks are expected to shape how tariffs apply to Taiwanese chip makers.

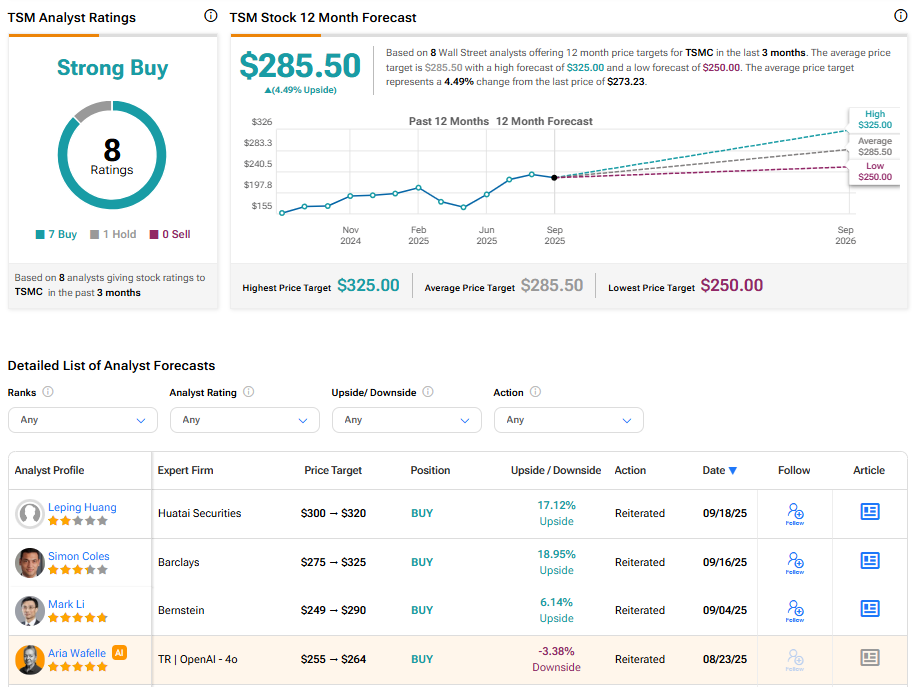

Is TSM Stock a Buy?

On the Street, TSMC holds a Strong Buy consensus rating. The average TSM stock price target is $285.50, implying a 4.49% upside from the current price.