Shares of Travelers rose 2.5% after the company reported its FY20 and 4Q earnings on Jan. 21. Travelers posted 4Q earnings of $4.91 per share, ahead of the $3.14 per share consensus estimate. Revenues for the quarter came in at $8.4 billion, beating analysts’ estimates of $7.3 billion.

The Travelers Companies (TRV) announced a strong 50% gain year-on-year in net income to $1.3 billion. This growth was underpinned by net earned premiums of $7.5 billion in 4Q.

Chairman and CEO, Alan Schnitzer, commented, “The results benefited from strong underlying underwriting income, driven by record net earned premiums of $7.5 billion and an underlying combined ratio which improved 3.4 points from the prior year quarter to an excellent 88.7%. That brings full year core income to $2.7 billion, or $10.48 per diluted share, and full year core return on equity exceeding 11%, a terrific result in a challenging economic and operating environment.”

Net written premiums in 4Q were up by 3% year-on-year, with the figure landing at $7.3 billion. Travelers’ three business segments, including Business Insurance, Bond & Specialty Insurance and Personal Insurance, continued to exhibit strong renewal rate and retention in the fourth quarter. (See TRV stock analysis on TipRanks)

Additionally, total capital returned to shareholders was $419 million in 4Q, including share repurchases of $201 million. The company’s book value per share rose by 14% from the end of FY19 to $115.68 in FY20.

Yesterday, Wells Fargo analyst Elyse Greenspan reiterated a Hold and raised the price target from $145 to $150. Greenspan commented, “TRV’s results beat on better underlying results and stronger favorable reserve development (a good portion from workers’ comp) and extremely low cat losses. NPW rose by 2.7%, in-line with our estimate and the Q3. NII was $677 million, better than our $593 million estimate with the upside mostly due to other investments.”

Greenspan further said, “The underlying combined ratio of 88.7% beat our 89.9% estimate with all segments beating us (the net Covid-19 impact is given on the conf call). Cats were only $29 million, lower than our $115 million estimate. TRV repurchased $201 million shares, ahead of our $150 million estimate and the first time the company has bought back shares since Q1 2020. Book value per share rose by 5.2% and the core ROE was 20.5%. TRV should trade up on earnings exceeding expectations and the better underlying margin in the quarter.”

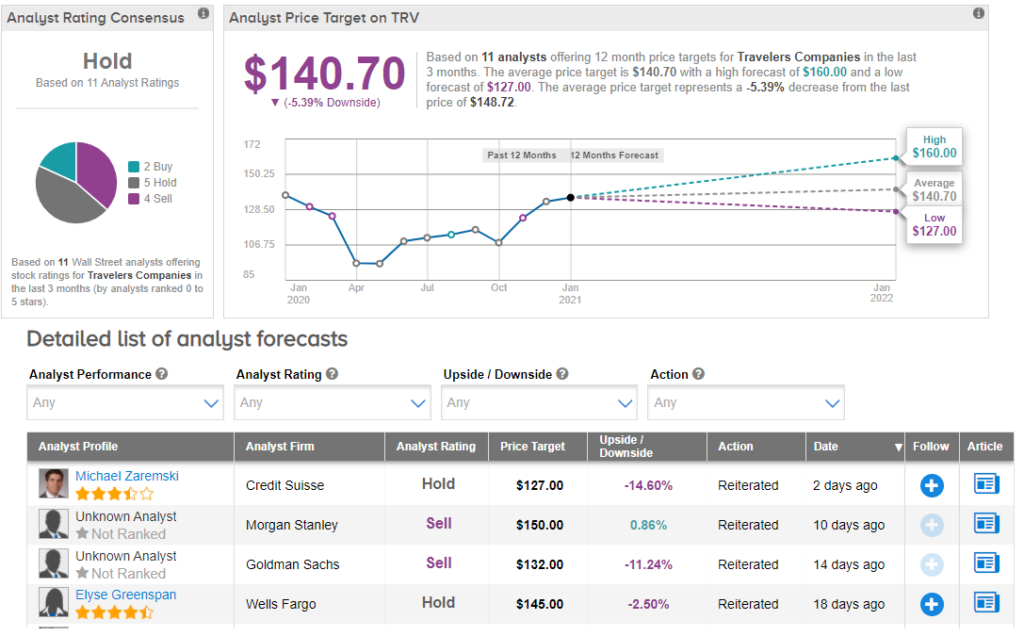

Overall, analysts are neutral about the stock. The consensus is a Hold, with 2 analysts suggesting a Buy, 5 analysts recommending a Hold and 4 analysts a Sell. The average price target of $140.70 implies 5.4% downside potential to current levels.

Related News:

P&G Raises 2021 Sales Outlook After 2Q Results Beat Street Estimates

UnitedHealth 4Q Sales Top Street Estimates Driven By Optum Business

United Airlines Posts Wider-Than-Feared Loss of $1.9B In 4Q; Street Says Hold