The efforts by Japanese automobile manufacturer Toyota (TM) to completely take over its machine making unit Toyota Industries (TYIDF) in a $31.3 billion stock deal have hit a bump in the road.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Toyota on Monday noted that it is unlikely to progress with the move before February. The update lifted TM shares nearly 2% in early Monday trading.

The initial timeline was to tender the offer by December 2025. However, the proposed buyout is facing regulatory delays in several jurisdictions under antitrust rules, although it has also been stamped in several others such as Australia and Canada.

Akio Sets Eyes on Toyota Industries

Toyota is the biggest carmaker in the world, by volume. The company was founded by Kiichiro Toyoda and has its roots in Toyota Industries, which was established by Kiichiro’s father, Sakichi Toyoda, as Toyoda Automatic Loom Works.

Toyota Industries is part-owned by Toyota and launched as a manufacturer of automatic looms used to wave clothe and tapestries before expanding into the production of forklift trucks used in factories and other industrial settings to move objects. The subsidiary also makes vehicle parts.

However, Akio Toyoda, Toyota’s current chairman and Kiichiro’s grandson, wants to bring the unit under Toyota’s complete control and even take it private. Akio plans to achieve this through a holding company that will comprise Toyota itself, and the conglomerate’s unlisted real estate arm, Toyota Fudosan.

Akio also intends to personally commit over $6.7 million to the deal. However, the proposal faced criticism in June when it was raised, as some shareholders believe that the buy-out figure prices the subsidiary below its market value.

The latest update on the takeover bid comes as Toyota continues to record strong growth sales of its vehicles and is looking to transform its business into a mobility company.

Is TM a Strong Buy?

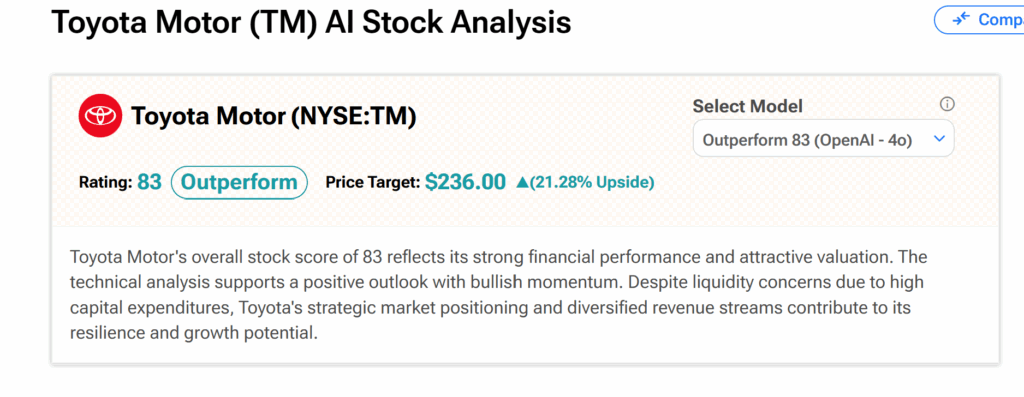

TipRanks’ AI Stock Analyst rates Toyota shares as Outperform with a score of 83 out of 100 due to its strong financial base and valuation. The average TM price target of $236 suggests a potential upside of about 21%.

Read more details about the AI stock analyst rating here.