Japanese carmaker Toyota (TM) saw its global sales figure climb for the eighth consecutive month in August, boosted by stronger demand in the U.S., its largest market. The company sold 844,963 vehicles across all markets in August, representing a 2.2% increase compared to the same period last year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

From the start of the year through August, it has sold 6.9 million units, which is 5% higher year-over-year. For context, throughout 2024, it sold 10.1 million vehicles.

In the U.S., sales jumped by 13.6% to 225,367 vehicles in August — or by 7.2% to 1.6 million units between January and August 2025. Toyota attributed the growth to the recovery from last year’s production stoppage, which was caused by recalls of its luxury midsize sport utility vehicle (SUV), Lexus TX, and its more affordable, mainstream counterpart, Grand Highlander.

Toyota Sees ‘Strong Performance’ in U.S.

Furthermore, the boost in U.S. sales was also due to “strong performance” in sales of the hybrid versions of its popular vehicles, such as the sedan Camry and the RAV4 SUV.

This is despite reports suggesting that the automobile manufacturer was considering ending the production of its Lexus ES sedans in Kentucky, with plans to merge the plant with its facility in Indiana, where it produces the Lexus TX SUVs. Some analysts viewed the move as a response to President Trump’s tariff strategy and the subsequent increase in production costs.

The boost in U.S. sales comes despite estimates showing that the number of vehicles sold across the country dropped by 300,000 units month-over-month. Yet, US-based automobile manufacturers Ford (F) and General Motors (GM) have similarly recorded gains as customers rush to snap-up purchases before the expiration of federal tax credits for electric vehicles.

Sales Remain Flat in China

Meanwhile, in China, Toyota’s second-largest market, sales growth in August was marginal, with 153,415 units sold — up 0.9% year-over-year. However, between January and August 2025, it sold 1.1 million vehicles, representing a 5.8% increase from the same period last year.

“Despite the ongoing severe market environment, including a shift to new energy vehicles and intensifying price competition, sales [in China] were up year-on-year thanks to the success of promotional measures tied to government subsidy policies and strong sales of the new battery electric vehicle bZ3X,” Toyota noted.

Back home in Japan, sales fell 12.1% year-over-year to 96,269 vehicles in August. That’s a 7.3% decline to 999,963 units since the start of the year. Toyota said it had to stop and delay deliveries of its vehicles in Japan due to the earthquake off the Kamchatka Peninsula.

This added to the pressure caused by the recall of its Prius models last year, the carmaker added.

Is TM a Strong Buy?

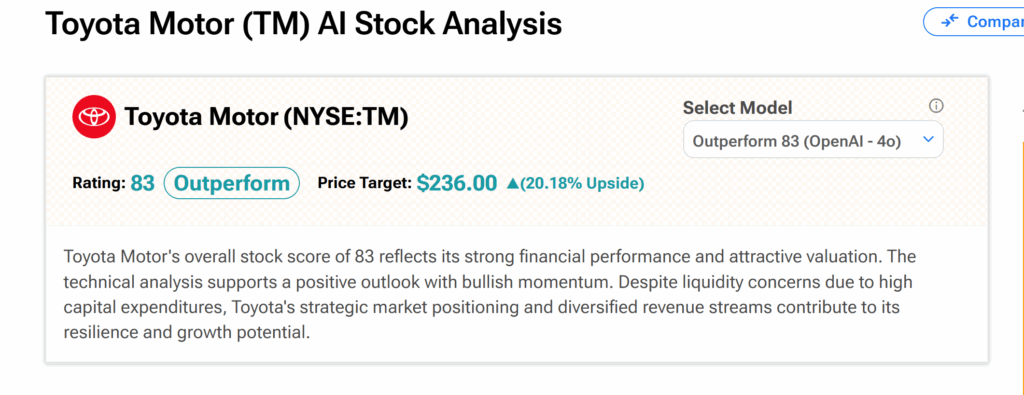

TipRanks’ AI Stock Analyst gives Toyota’s shares an Outperform rating score of 83 out of 100, citing its financial performance and valuation. The average TM price target of $236 suggests a 20.18% upside potential.