Shares of Toyota Motor (NYSE: TM) jumped 6.9% on January 4 to close near its 52-week high of $199.19 after the Japanese auto giant released record U.S. December and year-end 2021 sales.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

To add to the investors’ glee, Toyota’s numbers outpaced General Motors Co. (NYSE: GM) in 2021, defying the best-selling carmaker in the U.S. for the first time since 1931. The revolutionary beat was driven by better management of the supply chain issues by Toyota versus GM.

December and Full-Year Delivery Update

Markedly, U.S. sales grew 10.4% year-over-year (on a volume basis) to 2.33 million vehicles during the calendar year 2021. Comparatively, GM delivered 2.2 million vehicles for the full year 2021.

The company reported U.S. sales of 174,115 vehicles in the month of December 2021. This implies a decline of 30.2% year-over-year on a volume basis and 27.7% on a daily selling rate (DSR) basis.

Additionally, Toyota stated that it continued to be the number one seller of electrified vehicles for 22 years in a row. Total electrified powered vehicle (EPV) sales, including hybrids, plug-ins and fuel cells, grew 73.2% to 583,697 in 2021.

Segment-wise, the Toyota division recorded U.S. sales of 150,072 vehicles in December, down 29% on a volume basis. For the full year, Toyota reported U.S. sales of 2,027,786 vehicles, up 10.3 percent year-over-year.

Notably, Toyota continues to be the number one retail brand for the 10th consecutive year. Furthermore, Toyota Camry, Highlander, RAV4, Sienna, Tacoma and Lexus NX continue to be reckoned as the best-selling models in their respective segments.

Furthermore, the Lexus division posted U.S. sales of 24,043 vehicles, down 37.1% in December while the yearly Lexus U.S. sales came in at 304,476 vehicles, up 10.7% year-over-year.

Management Weighs In

Jack Hollis, SVP of Automotive Operations Group at Toyota Motor North America commented, “Despite a second consecutive year of challenges, TMNA focused on delivering an exceptional customer experience, and we remain optimistic as our electrification strategy further evolves.

Looking forward to the future, he added, “Thanks to our phenomenal dealers and world-class purchasing and manufacturing teams, our inventory continues to improve and we’re preparing to introduce 21 all-new, refreshed or special edition vehicles in 2022.”

Analysts’ Recommendation

The stock has picked up a rating from one analyst in the past three months.

On November 22, Bank of America Securities analyst Kei Nihonyanagi increased the price target to $218 (9.44% upside potential) from $210.70 while reiterating a Buy rating.

Smart Score

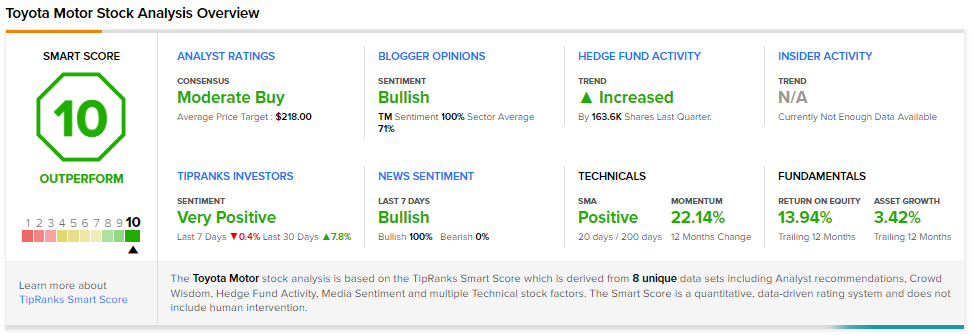

Toyota Motor scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has a strong potential to outperform market expectations.

Download the TipRanks mobile app now

Related News:

Brown & Brown, Inc. Acquires Assets of HARCO

Lockheed Martin Reveals its F-35 Program Growth in 2021

Theranos CEO Elizabeth Holmes Found Guilty in a Lengthy Fraud Trial