Pershing Square Capital Management, L.P., a director, and more than 10% owner of Howard Hughes’ (NYSE:HHC) shares, purchased 1,560,205 shares on November 29 for a total value of $109.2 million. Howard Hughes is a real estate development and management company with a major focus on several master-planned communities (MPCs).

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

It is worth noting that the billionaire investor Bill Ackman is the CEO and founder of Pershing. Ackman is also the chairman of Howard Hughes’ board.

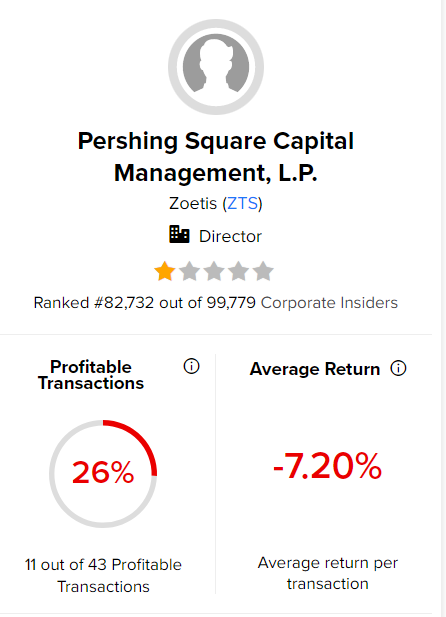

The total value of Pershing’s holdings of HHC stock currently stands at $1.13 billion. Also, Pershing’s performance track record shows a 26% success rate in 43 transactions so far, with an average negative return of 7.2% per transaction.

TipRanks offers daily insider transactions and a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is HHC a Good Stock to Buy?

On TipRanks, HHC stock has a Moderate Buy consensus rating based on two unanimous Buys. The average Howard Hughes stock price target of $76 implies 1.96% upside potential. The stock is down 27% so far this year.

Supporting the bull case is the stock’s valuation. Currently, Howard Hughes’ price/earnings ratio is trading at 15x, reflecting a 46.3% discount from the sector’s median of 27.95. Overall, the stock scores 8 out of 10 on TipRanks’ Smart Score rating system, pointing to its potential to outperform.