Tesla Inc. will be added to the S&P 500 index on Monday, December 21, and its weighting in the index will be determined by its stock price at the close of trading on Friday. Tesla’s current market value is around $610 billion and will float around 80% of that ($490 billion) on the S&P 500. CEO Elon Musk and other insiders will hold the additional 20%.

Tesla (TSLA) is the most valuable company ever to be added to the index and at the current valuation, will make up around 1.5% of the index, making it the largest weighting ever added. Berkshire Hathaway, added in 2010, currently holds that record at 1.4%.

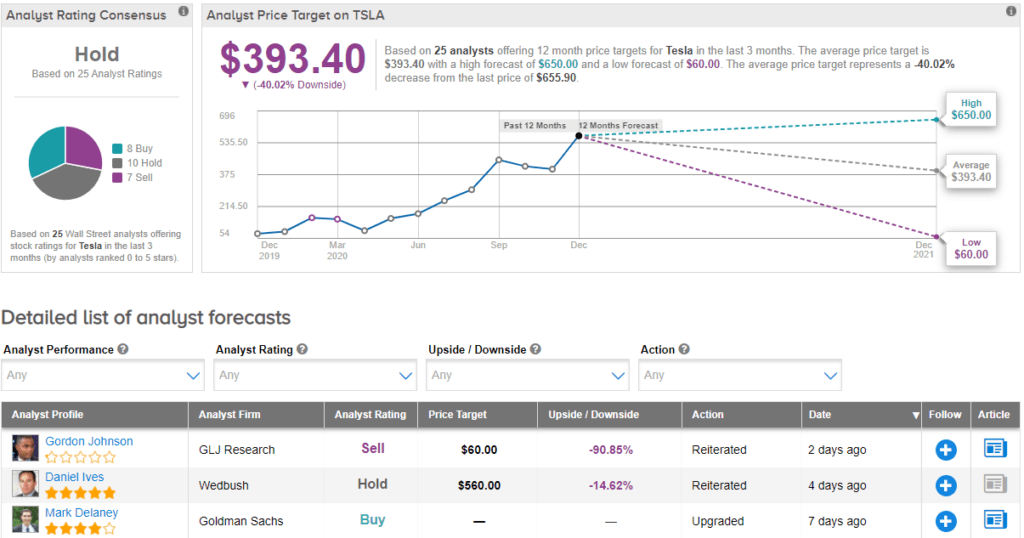

Tesla shares have climbed 58% higher since the announcement of its inclusion in the index and has gained 673% year-to-date. It ended yesterday’s session up 5.32% at a record high price of $655.90 per share. (See TSLA stock analysis on TipRanks)

GLJ Research analyst Gordon Johnson reiterated his Sell rating two days ago with a price target of $60 (91% potential downside). Johnson suggested that the meteoric rise in value this year could come to a halt post-listing, citing the loss of government-backed EV credits from rival carmakers and declining market share in China and Europe as possible catalysts.

Consensus among analysts is a Hold based on 8 Buys, 10 Holds and 7 Sells. The average price target of $393.40 implies a potential downside of 40% over the next 12 months.

Related News:

AAR Misses Q2 Street Estimates; Shares Plunge 5%

U.S. Steel Dips 6% On Higher-Than-Feared Loss Outlook, Street Sees 47% Downside

Accenture Gains 7% On Blowout 1Q Results; RBC Lifts PT