Electric vehicle giant Tesla (TSLA) is eyeing its newest major market, India, and looking to make a huge landing therein. However, that push will not be uncontested, even if the contest might be looking a bit lopsided. All of this together adds up to a big potential win for Tesla, and shareholders seem to be starting the victory party. Tesla shares gained modestly in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

New reports say that Tesla is firing up its presence in India after its recent launch, but the reception has been a bit tepid. It did not help that Tesla reportedly had preorders open for the last, roughly, 10 years, but only just started selling cars in India in July. This left some preorder customers waiting years, a move that does not engender a lot of goodwill. Throw in high prices on the cars that did make it there and a weak charging network, and Tesla faces an uphill battle.

Further, Tesla is facing a major competitor in BYD (BYDDF), who is also making a play for the Indian market. However, BYD is not without problems of its own, as relations between India and China have not been on a good footing for quite some time now.

Picking a Winner

But Warren Buffett may have picked a winner in that particular fight, as he no longer has a stake in BYD at all, reports note. Buffett had a stake in BYD going back almost 20 years, but now, new filings show that he has departed the automaker altogether.

Reports suggest that Buffett has pivoted to Treasury bills right now, with his presence therein going from flat to $39 million in the course of about six months. There was no distinct reason given for Buffett’s abandonment of his position, with several possibilities emerging from liquidity needs to just a feeling that BYD has gone as far as it can. Either way, that does suggest a potential winner in India, if Buffett is no longer connected to it.

Is Tesla a Buy, Hold or Sell?

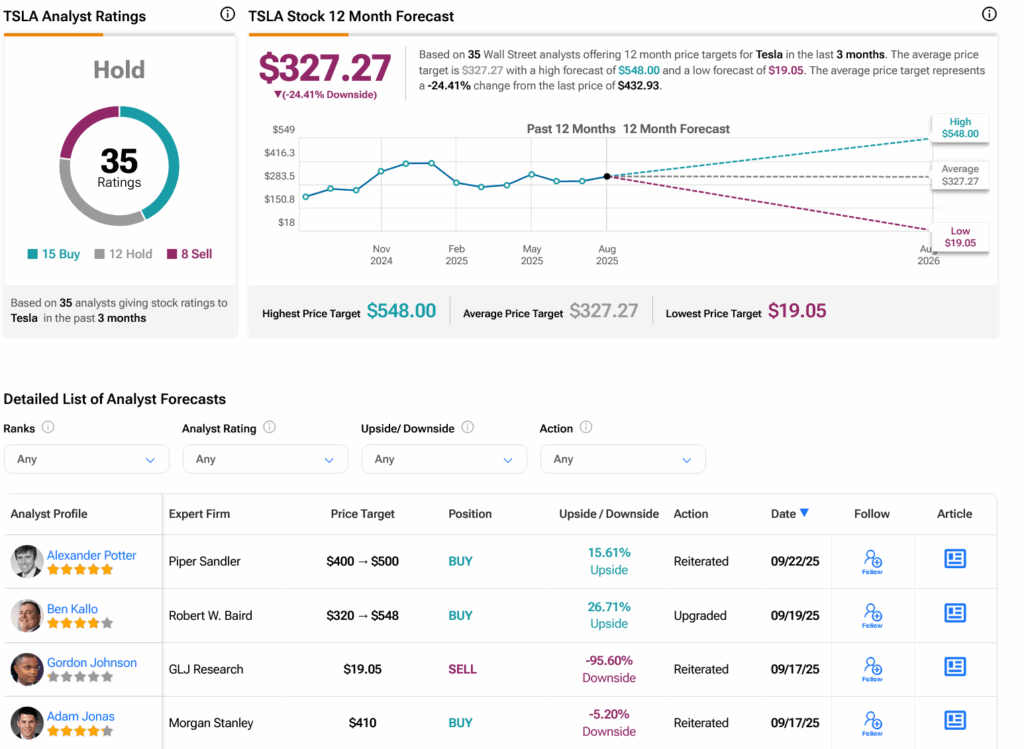

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 15 Buys, 12 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. After a 70.43% rally in its share price over the past year, the average TSLA price target of $327.27 per share implies 24.41% downside risk.