Shares of BYD (BYDDF) are down more than 3% today after a CNBC report noted that Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) had sold its entire stake. Since first acquiring 225 million BYD shares in 2008, the investment conglomerate has reaped massive profits on its bet on the Chinese electric vehicle (EV) maker. Buffett made the investment on the advice of his late partner and friend, Charlie Munger, who once described BYD’s CEO Wang Chuanfu as a “damn miracle.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Commenting on the sale, Li Yunfei, BYD’s general manager for branding and PR, wrote on Weibo, “In stock investing, buying and selling are normal practices. We’re grateful to Munger and Buffett for their recognition of BYD, and for their 17 years of investment, support, and companionship.”

What Drove Buffett’s BYD Exit?

Berkshire disclosed in its March 31 filing that the value of BYD’s holdings had dropped to zero. Since August 2022, Buffett has steadily trimmed Berkshire’s stake in the company, capitalizing on the solid surge in BYD’s share price. By June 2024, Berkshire’s stake had fallen below 5%, exempting the company from publicly disclosing future trades.

Multiple factors may have influenced Buffett’s decision to exit completely. Intensifying competition in China’s EV market, led by Tesla (TSLA), Nio (NIO), and Li Auto (LI), has forced BYD into an aggressive price-cutting strategy. While this has helped protect market share, it has also weighed heavily on its margins and profitability.

Additionally, China’s economic slowdown and policy uncertainty may have weakened Buffett’s confidence in staying invested in such a competitive, low-margin industry. Owing to current headwinds, the company has lost $45 billion in market value from its all-time highs over the past four months. Meanwhile, BYD is aggressively expanding its international footprint to protect its market share and profitability.

To conclude, while Berkshire’s exit may not shape BYD’s future directly, it highlights rising doubts about the company’s ability to grow market share while staying profitable in a tough EV market.

Is BYD Stock a Buy, Hold, or Sell?

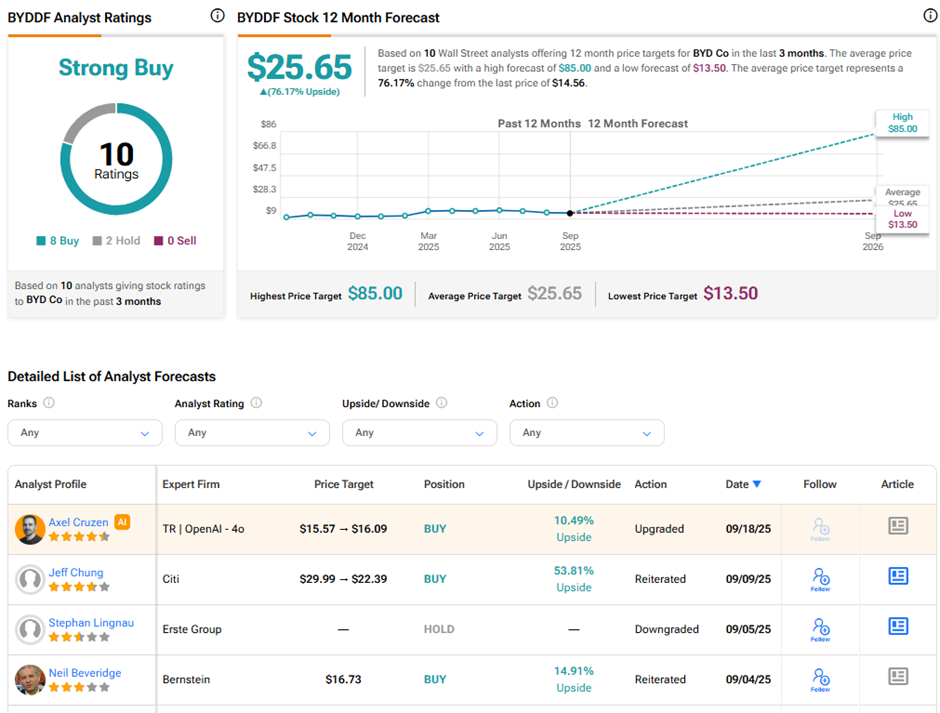

Despite the ongoing concerns, analysts remain optimistic about BYD’s long-term outlook. On TipRanks, BYDDF stock has a Strong Buy consensus rating based on eight Buys and two Hold ratings. The average BYD price target of $25.65 implies 76.2% upside potential from current levels.