Tesla stock (TSLA) kept climbing Monday morning after another bullish forecast pushed the electric-vehicle maker closer to its all-time high. TSLA shares were up 0.7% at $429 in pre-market trading, extending a nine-session surge that’s lifted the stock 23%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

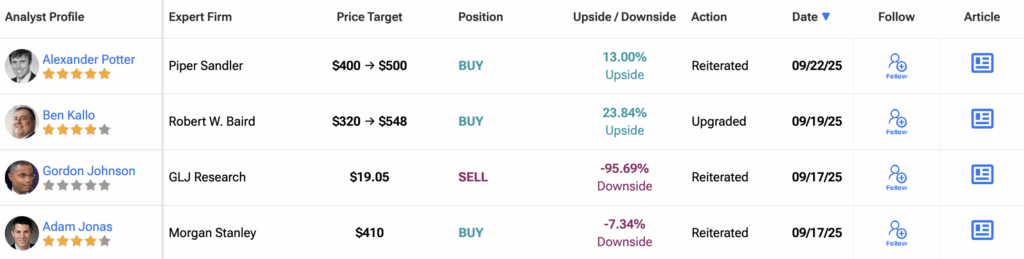

The latest push came from Piper Sandler analyst Alexander Potter, who raised his price target to $500 from $400 after returning from a research trip in China. He said that while competition in EVs is rising, Tesla still dominates the race for real-world artificial intelligence. “Bottom line: Tesla remains our top idea for investing in autonomous vehicles and robotics,” Potter wrote.

Tesla Banks on AI Growth

Potter kept his Buy rating and framed Tesla’s valuation as a reflection of its edge in AI. “We think Tesla’s multiple is so high because the company is using A.I. to disrupt markets that are almost unimaginably large,” he added. His $500 target implies Tesla could trade at 200 times expected 2026 earnings.

Just days ago, Baird’s Ben Kallo also upgraded Tesla to Buy and raised his target to $548. Overall, 47% of analysts now rate the stock a Buy, with the average price target rising to $336, according to FactSet.

Momentum Drivers Stack Up

The bullish calls come at a time when Tesla has rolled out a self-driving taxi service in Austin, with plans to expand into Nevada and Arizona. The company also expects to begin selling humanoid robots in 2026. Add in Elon Musk’s $1 billion stock purchase and last week’s Fed rate cut, and the catalysts have multiplied.

Technical analysts warn the stock is close to overbought territory, with Fairlead Strategies’ Katie Stockton pointing to $489 as “the next and final resistance.” Tesla shares have ranged from $212 to $489 this year, an 80% swing that showcases its volatility.

For now, Tesla stock is riding strong tailwinds. Whether it breaks through resistance or pauses for breath could decide how long this rally lasts.

Is Tesla Stock a Buy, Hold, or Sell?

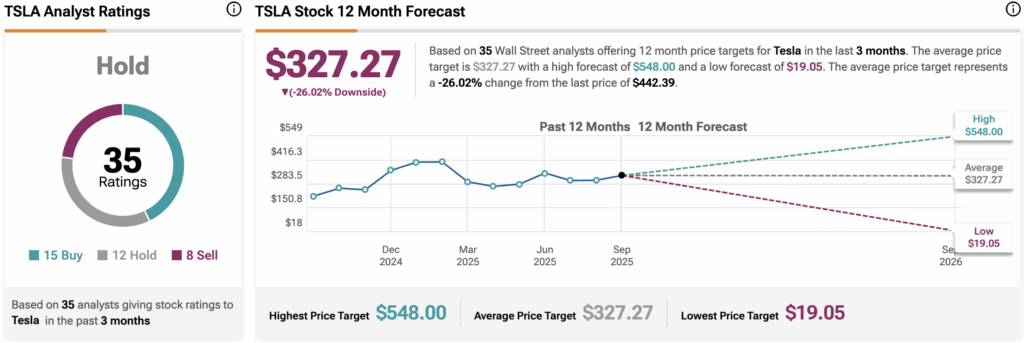

Turning to TipRanks, Tesla is still considered a Hold based on 35 ratings assigned by analysts in the last three months. The average price target for TSLA stock is $327.27, implying a 26% downside from the current price.