Tesla (NASDAQ:TSLA) is once again reducing the price of some of its electric vehicles in the US. It is noteworthy that the EV behemoth has lowered prices twice this month and a total of six times since the beginning of 2023.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Recently, Tesla’s Model Y long-range model, Model Y performance, and Model 3 rear-wheel drive all saw price reductions of 5.6%, 5.2%, and 4.7%, respectively.

Additionally, Tesla has been lowering prices across the board after having triggered a price war in China. It lowered car prices last week in Singapore, Singapore, and Europe. The company has been missing analysts’ delivery expectations for the past few quarters, so these price reductions are an attempt to increase demand for its vehicles.

Elon Musk has been working hard to expand all of his businesses. Being the CEO of Twitter, he reassured advertisers that running advertisements on Twitter’s platform will be beneficial.

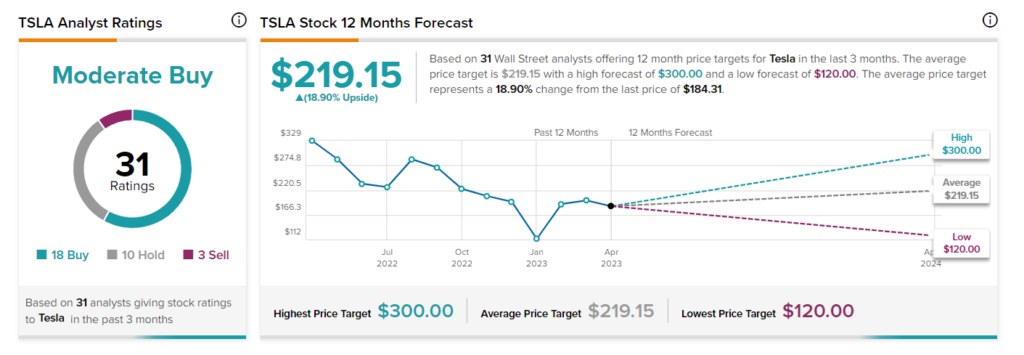

Is Tesla Stock a Buy, Sell, or Hold?

Wall Street is cautiously optimistic about Tesla, with a Moderate Buy consensus rating based on 18 Buys, 10 Holds, and three Sells. The average price target of $219.15 suggests upside of 18.9%. The stock is up 70.5% so far in 2023.