After witnessing higher demand for its vehicles in China and the U.S., Tesla (NASDAQ:TSLA) is now expanding its discount strategy to Europe, Israel, and Singapore. Meanwhile, the latest move continues to raise concerns about its profit margin.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company has reduced prices in the European market, including Germany and France, for the Model 3 and Model Y by 4.5% to 9.8%.

Furthermore, in Israel, Tesla cut the price of its base Model 3 by 25%. In Singapore, the company has provided discounts ranging from 4.3% to 5% for Model 3 and Model Y.

It is worth mentioning that Tesla reduced prices for its Model S sedan, Model X sport utility vehicle, Model 3 sedan, and Model Y crossover vehicles in the United States last week. In fact, so far in 2023, the company has cut the price of its base Model 3 and Model Y in the U.S. by about 11% and 20%, respectively.

Tesla will release its Q1 earnings report on April 19.

Is Tesla Stock a Buy, Sell, or Hold?

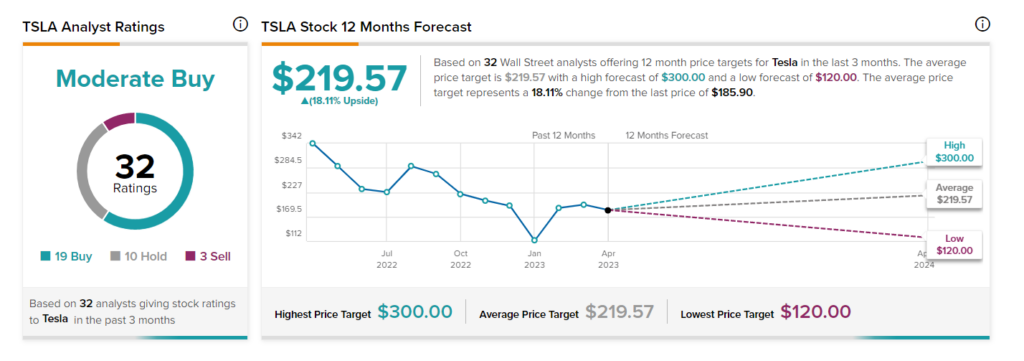

Wall Street is cautiously optimistic about Tesla, with a Moderate Buy consensus rating based on 19 Buys, 10 Holds, and three Sells. The average price target of $219.57 suggests upside of 18.1%.