Tesla (NASDAQ:TSLA) announced record deliveries of 422,875 vehicles in the first quarter of 2023. The company’s Q1 deliveries increased by 36% year-over-year. However, it lagged behind analysts’ consensus estimates of 432,000 units.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tesla’s price-cut strategy in the U.S., Europe, and China appears to have increased the number of deliveries. Early in 2023, the company reduced the cost of its Model 3 sedan and Y crossover after fourth-quarter deliveries fell short of investors’ expectations. Additionally, some Tesla models were eligible for a $7,500 tax credit, which increased demand in the United States.

Meanwhile, Tesla faced several headwinds, including macro pressures and rising competition in China and the U.S. Additionally, the lower selling price of cars and high input costs may have an impact on Tesla’s Q1 results, which are anticipated to be released on April 19, 2023. The company produced 440,808 vehicles in the first quarter of 2023.

According to Dan Levy, an analyst at Barclays, there may be slight price reductions as inventories rise due to production ramp-ups in Berlin and Austin. Nevertheless, Levy is bullish on TSLA stock with a price target of $275 (32.6% upside potential).

What is the Future of TSLA Stock?

Tesla investors had a difficult year in 2022 as the stock lost 65% of its value. This is attributed to a change in CEO Elon Musk‘s priorities following Twitter’s acquisition, demand issues, and supply chain difficulties.

However, Tesla has managed to get past the majority of these obstacles and has also made a number of investments to increase production levels. This is demonstrated by the stock’s 91.9% increase so far in 2023.

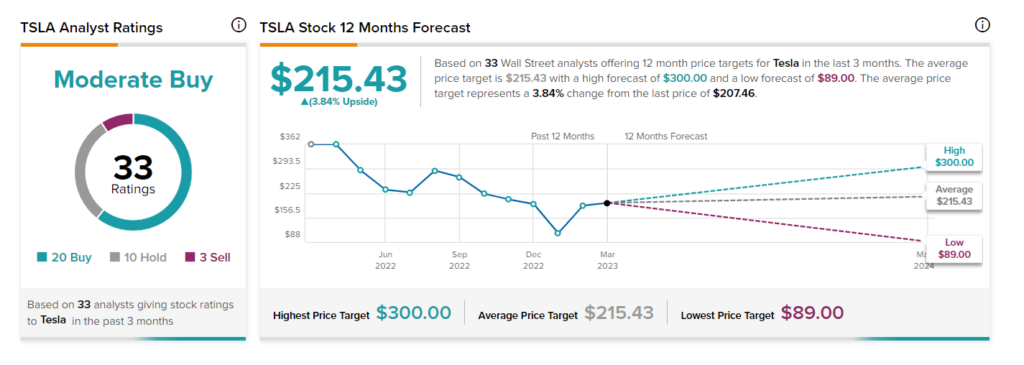

The Street remains cautiously optimistic about TSLA stock. It has a Moderate Buy consensus rating based on 20 Buy, 10 Hold, and three Sell recommendations. Further, the average price target of $215.43 implies 3.8% upside potential.