EV maker Tesla (TSLA) would turn into an ordinary car manufacturer and slump in value by up to 80% if Elon Musk left the business, a former executive warned today.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Decade Shaping Decision

Peter Bardenfelth-Hansen, former business development head for the EMEA region, told the BBC ahead of this afternoon’s vote on CEO Musk’s record-breaking $878 billion pay package, that the decision will set the fate of Tesla for the decade.

The Tesla board has made its stance on the pay package clear. They have told investors they can either pay Musk or risk losing him.

The package ties Musk’s compensation to Tesla’s long-term performance goals, which could see the company’s valuation surge to $8.5 trillion if fully met.

The board and many shareholders argue that only Musk can deliver on his vision of transforming Tesla into an AI powerhouse, complete with fleets of self-driving robotaxis and humanoid robots.

Elon or No Elon?

“Will the next 10 years be under the leadership of Elon or not?” Bardenfelth-Hansen said. “What would Tesla be without Elon? The answer is an OEM, a car manufacturer without the extra bits.”

He said Tesla’s current market valuation of $1.48 trillion would “plummet” by between 70% and 80%. “The valuation is built on the Elon Musk vision of the future. It is not about falling car sales or his links to right-wing politicians. It is about robotaxis and the Optimus humanoid,” he said.

Indeed, they both play an important part in creating Tesla’s new ecosystem of services – see below:

He added that he expects the pay package to be approved today, but believes Musk works better when faced with adversity. “If you think he is out for the count, he gets up again,” he said.

Is TSLA a Good Stock to Buy Now?

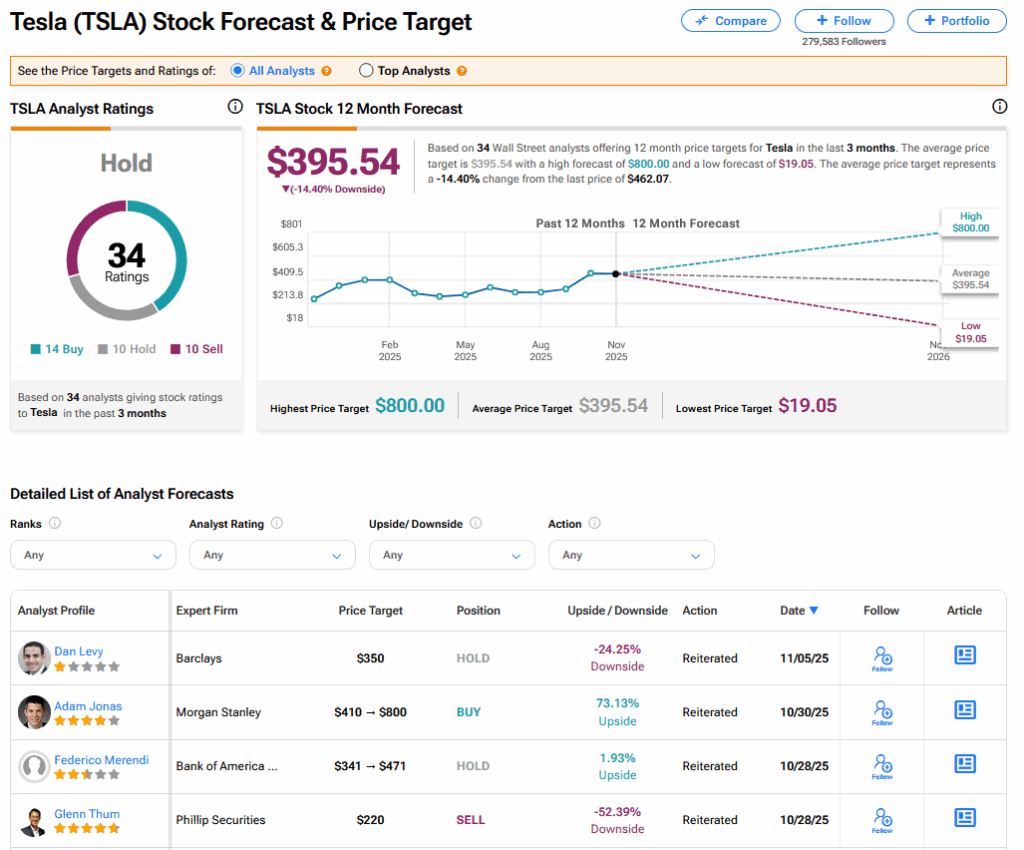

On TipRanks, TSLA has a Hold consensus based on 14 Buy, 10 Hold and 10 Sell ratings. Its highest price target is $800. TSLA stock’s consensus price target is $395.54, implying a 14.40% downside.