Tesla (TSLA) shareholders prepare to vote on CEO Elon Musk’s record-breaking pay package on Thursday, November 6. The outcome will decide whether Musk secures the largest compensation deal in corporate history. Despite the looming decision, TSLA stock gained 4% in Wednesday’s session before slipping 0.40% in after-hours trading. Year-to-date, TSLA stock has gained over 14%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla Faces Its Biggest Vote Tonight

Musk’s proposed pay package has been widely described as potentially worth up to $1 trillion, though after accounting for various costs, its real value is estimated closer to $878 billion.

The compensation would be granted in the form of stock options, giving Musk up to 423.7 million additional Tesla shares over the next decade. However, the full payout would only materialize if Tesla achieves an ambitious market capitalization of $8.5 trillion in a 10-year period, marking one of the most significant valuations in corporate history.

Additionally, the deal is tied to a series of milestones over the next decade, focused on Tesla’s push to lead in self-driving technology and humanoid robotics.

The Debate Is On

Musk has said he needs around 25% voting control of Tesla to ensure the company’s AI projects stay under his leadership, and this pay package is designed to raise his ownership to that level. For context, Musk currently owns about 15% of Tesla, giving him the advantage to vote his own shares in the upcoming decision.

With reference to this vote, Tesla’s board is urging shareholders to approve the plan, with Chair Robyn Denholm warning that Musk could walk away if the deal is rejected.

On the flip side, Norway’s sovereign wealth fund recently announced it would vote against Musk’s proposed package, citing concerns about potential share dilution and too much dependency on one person. Similarly, several smaller public pension funds, including the American Federation of Teachers and New York City retirement systems, along with major proxy advisors ISS and Glass Lewis, have also said they will oppose the plan.

Is Tesla a Buy, Sell, or Hold?

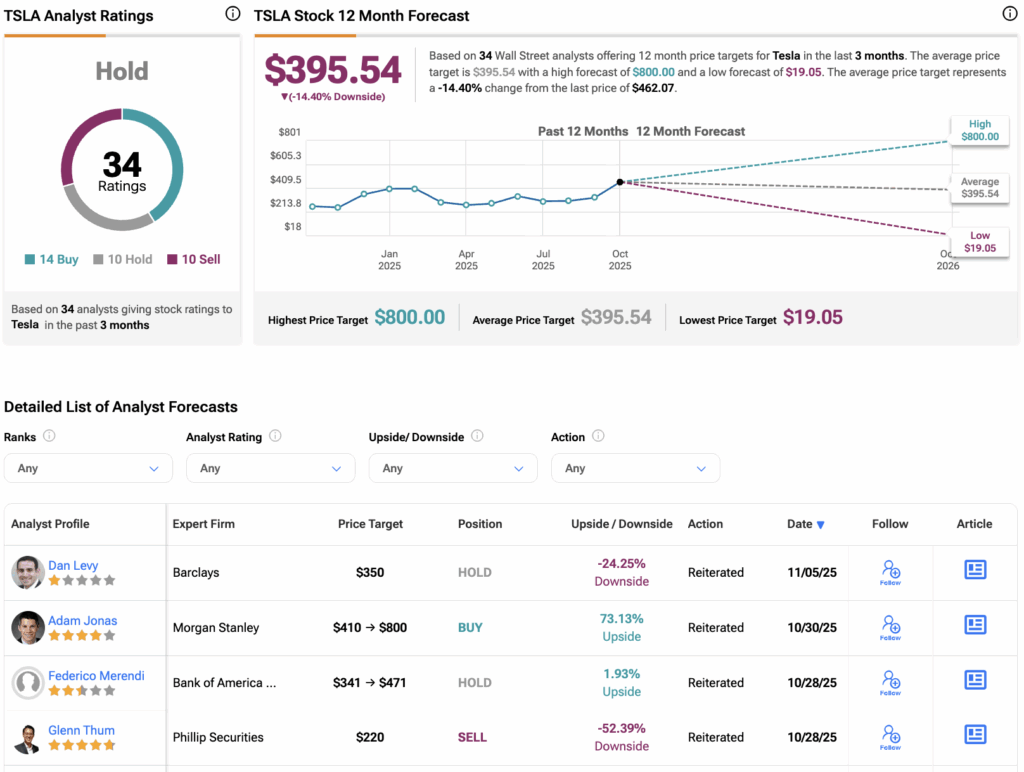

Ahead of this crucial vote, analysts have maintained a neutral stance on Tesla stock. According to TipRanks, TSLA stock has received a Hold consensus rating, with 14 Buys, 10 Holds, and 10 Sells assigned in the last three months. The average Tesla stock price target is $395.54, suggesting a potential downside of 14.4% from the current level.