Shares of American wireless network operator, T-Mobile US, Inc. (TMUS), closed about 4% higher on Wednesday, after the company delivered better-than-estimated earnings for the first quarter of fiscal 2022.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue increased 1.83% over the prior-year period to $20.12 billion, but missed estimates by $33.6 million. Meanwhile, earnings per share (EPS) at $1.41 exceeded the consensus estimate of $1.09.

Q1 Performance

The company witnessed 1.3 million postpaid net customer additions, which was its highest first-quarter figure in eight years. Furthermore, T-Mobile continued to extend its 5G leadership. Its extended range of 5G covers 315 million people, its ultra capacity 55G covers 225 million people, and its 5G devices now make up over half of its total network traffic.

Management Weighs In

Mike Sievert, CEO of T-Mobile, commented, “T-Mobile continues to be the growth leader in this industry, with another beat and raise quarter that delivered front-of-the-pack postpaid, new account, and broadband customer results. Only the Un-carrier’s unparalleled network leadership in the 5G era has enabled us to give customers the best network and best value without compromise, and effectively solve one of the most prevalent pain points in the wireless industry.”

Outlook 2022

Buoyed by this execution strength, T-Mobile raised its guidance for 2022. Postpaid net customer additions are anticipated in the range of 5.3 million to 5.8 million. Core adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) is seen landing between $25.8 billion and $26.2 billion, which is an increase compared to the previous range of $25.6 billion to $26.1 billion.

Analyst Take

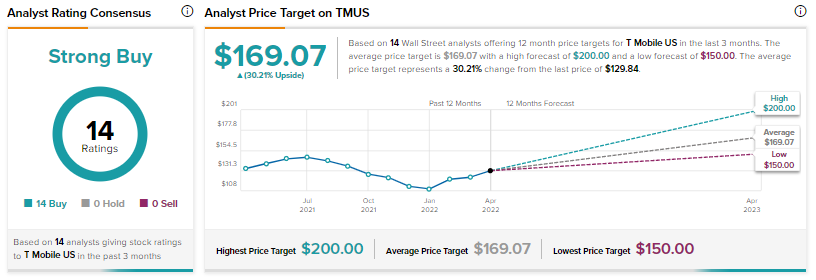

Yesterday, RBC capital analyst Kutgun Maral reiterated a Buy rating on the stock alongside a price target of $152.

Overall, the Street has a Strong Buy Consensus rating on T-Mobile based on 14 unanimous Buys. The average T-Mobile price target of $169.07 implies a potential upside of 30.21%. That’s on top of the nearly 13.5% gains recorded by the stock so far this year.

Closing Note

The robust Q1 showing further reinforces the investment thesis for T-Mobile. Notably, while the broader market has been trending lower, the company’s share price gains in 2022 stand apart.

Moreover, a boost in guidance and the unanimous Bullish stance of Wall Street analysts should further buoy investor sentiment towards the stock. TipRanks data highlights that investors are very positive about T-Mobile with the number of portfolios holding T-Mobile up about 2.4% in the last thirty days.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Firms Eye Bed Bath & Beyond’s Buybuy Baby Unit; Shares Surge

Twitter & Elon Musk Saga Ends on Definitive Cash Deal Worth $44B

Hawaiian to Kick off In-Flight Internet Services with Starlink