Stock indices finished today’s trading session in the green. Indeed, the Nasdaq 100 (NDX), S&P 500 (SPX), and the Dow Jones Industrial Average (DJIA) gained 1.45%, 0.8%, and 0.38%, respectively.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

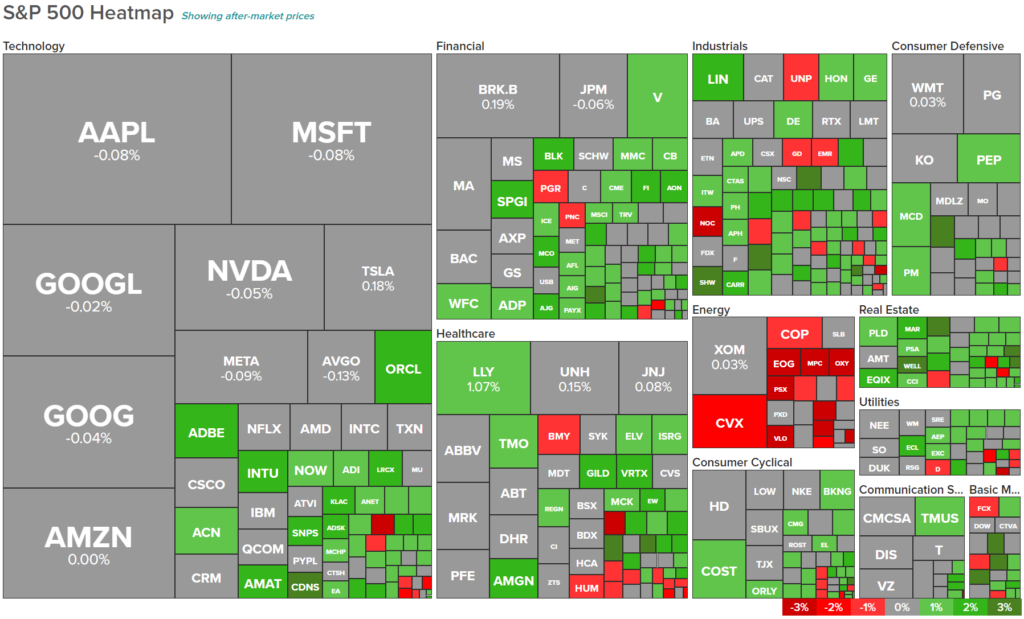

The energy sector (XLE) was the session’s laggard, as it lost 3.31%. Conversely, the consumer discretionary sector (XLY) was the session’s leader, with a gain of 1.99%. Overall, a quick look at the S&P 500 heatmap shows a lot more green throughout the index than red.

Furthermore, the U.S. 10-Year Treasury yield decreased to 4.73%, a drop of seven basis points. Similarly, the Two-Year Treasury yield also decreased, as it hovers around 5.05%.

Last updated: 2:23PM EST

Equity markets are mixed so far in today’s trading session. Earlier today, the U.S. Census Bureau released its Factory Orders report, which measures the change in the total value of new purchase orders placed with manufacturers. During August, factory orders increased by 1.2% on a month-over-month basis. This beat expectations of a 0.2% increase.

However, when excluding transportation, factory orders increased by 1.4%, which was an improvement from the previous report of 0.9%

Last updated: 11:55AM EST

On Wednesday, the Institute for Supply Management released its monthly report for the ISM Non-Manufacturing Purchasing Managers’ Index, which measures the overall economic condition of the non-manufacturing sector.

A number over 50 represents an expansion, whereas anything below 50 signals a contraction. The report came in at 53.6, which was in line with expectations and lower than last month’s reading of 54.5.

It’s worth noting that this indicator has been in an overall downtrend since peaking in December 2021, when it hit a high of 69.1. If this trend continues, it might not take long before the non-manufacturing sector enters into a period of sustained contraction.

Furthermore, the ISM Non-Manufacturing Employment report came in at 53.4, which also decreased from last month’s report of 54.7.

Last updated: 9:30AM EST

Stocks opened higher on Wednesday morning, with the Nasdaq 100 (NDX), S&P 500 (SPX), and the Dow Jones Industrial Average (DJIA) up by 0.43%, 0.24%, and 0.15%, respectively, at 9:30 a.m. EST, October 4.

The ADP jobs growth data indicated that job growth totaled 89,000 for the month of September, down from an upwardly revised 180,000 in August and below the estimates of 160,000. The payroll processing firm’s jobs data also indicated a slowdown in wages as it declined to 5.9%, a fall for the 12th consecutive month in a row.

First published: 4:24AM EST

U.S. Futures are in the red on Wednesday morning following the higher-than-anticipated JOLTs jobs opening data released on October 3. Futures on the Nasdaq 100 (NDX), S&P 500 (SPX), and the Dow Jones Industrial Average (DJIA) are down by 0.50%, 0.32%, and 0.18%, respectively, at 4:15 a.m. EST, October 4.

The JOLTS report showed 9.61 million jobs opening in August, significantly higher than the 8.8 million projected openings for the month. Markets witnessed a huge sell-off in yesterday’s trading, dragging the DOW down to negative performance to date. In the meantime, WTI crude oil futures are trading down near $88.75 as of the last check. On the contrary, yields on the U.S. 10-year treasury are heading higher, hovering near 4.84%.

A strong and resilient labor market is fuelling concerns that the Federal Reserve may resort to additional interest rate hikes than previously expected. The Fed’s consistent rate hikes have done little so far to make a notable impact on the U.S. labor market. Traders will also closely watch the ADP private payroll data due today alongside the S&P Global Services PMI figures, Durable Goods, and Factory Orders data, all scheduled for today. Meanwhile, the first-of-its-kind ousting of the Speaker (Kevin McCarthy) from the House of Representatives adds to the overall uncertainty surrounding the looming government shutdown.

Turning towards stocks, after a series of layoffs over the past year, technology behemoth Meta Platforms (META) is again preparing to trim its workforce. This time, it plans to remove employees from the Agile Silicon Team, also known as FAST. At the same time, after a year of holding firm on prices and a massive crackdown on password sharing, video streaming giant Netflix (NFLX) is set to increase its prices in the coming months. Also, streaming service provider Spotify (SPOT) is aiming to seize a larger share of the audiobook market by offering 15 hours of free audiobooks each month to its premium-paying subscribers.

Elsewhere, European indices are trading in the red today, following their U.S. counterparts. The uncertain macroeconomic and political environment is increasing investors’ fear of the unknown.

Asia-Pacific Markets End Mixed on Wednesday

Asia-Pacific indices finished mixed on Wednesday, following the concerning labor data and the sell-off of stocks in the U.S. on Tuesday.

Hong Kong’s Hang Seng index finished lower by 0.78%, while China’s Shanghai Composite and Shenzhen Component indices ended up by 0.10% and 0.05%, respectively.

Japan’s Nikkei and Topix indices ended down by 2.28% and 2.49%, respectively.

Interested in more economic insights? Tune in to our LIVE webinar.