Investors are pumping more money into Franco-Italian automobile manufacturer Stellantis’ (STLA) shares after the company announced that it sold more vehicles in its recent quarter. The growth came amid multiple recalls that the top carmaker has had to issue in the U.S. this year, tainting its reputation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As of 9:46 a.m. EDT on Thursday, STLA stock traded over 8% higher for about $11 per share. This expanded on the 3.21% gains recorded the previous day.

Stellantis, the world’s fourth-largest carmaker, is the brain behind popular car brands such as Jeep, Ram, Chrysler, and Dodge. It also owns Peugeot, Citroën, Opel, and Alfa Romeo.

Stellantis Sees Sales Rebound

During the third quarter ended September, its American subsidiary, FCA U.S. LLC, sold 324,825 vehicles, surpassing its performance from the same period last year by 6%. The growth reverses the sales slump recorded in the same market in the previous quarter.

Furthermore, in terms of its commercial fleet, Stellantis reported a 22% year-over-year increase in sales to businesses, government agencies, and other organizations. Additionally, the carmaker reported that its total sales for September increased by 16% compared to the same month in 2024.

Providing further details, the automaker stated that its U.S. sales of Jeep, Jeep Wrangler, and Jeep Gladiator increased by 11%, 18%, and 43% year-over-year, respectively. The Jeep Wagoneer performed even better, soaring 122% compared to the same period last year — it marked the best-ever August and September monthly sales for the company.

Stellantis Races for AI Innovation

Meanwhile, the rising numbers come as Stellantis returned to sales growth in Europe, with sales in the region boosted by rising demand for plug-in hybrid (PHEV) and battery-electric (BEV) vehicles. It also trails the company’s renewed partnership with French tech firm Mistral AI to “co-develop solutions and scale AI adoption across Stellantis.”

Other automakers have also reported recent sales growth, with purchase numbers defying President Donald Trump’s volatile tariff regime on the auto industry. US-based automobile manufacturers Ford (F) and General Motors (GM) as well as foreign counterparts such as Toyota (TM) have similarly recorded gains as customers raced to snap up purchases before the expiration of federal tax credits for electric vehicles.

Is Stellantis a Strong Buy?

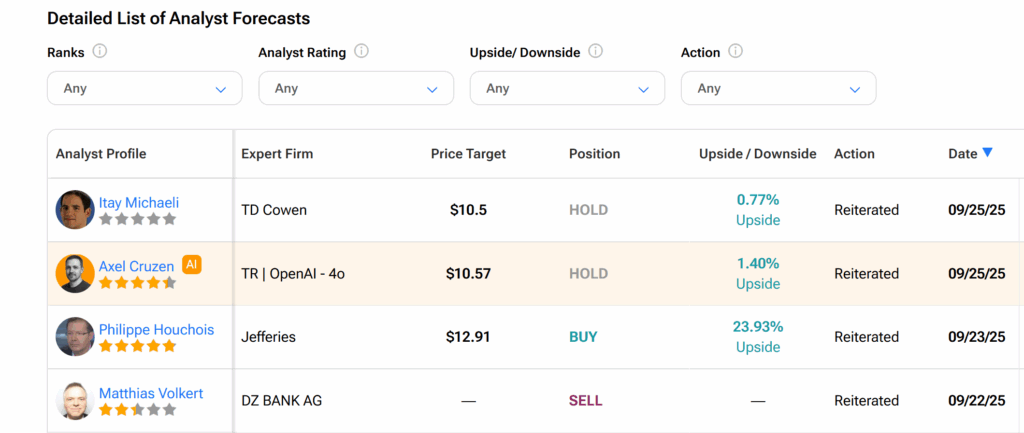

However, Stellantis’ shares currently have a Hold consensus recommendation from Wall Street, as seen on TipRanks. This is based on five Buys, 11 Holds, and two Sells assigned by 18 Wall Street analysts over the past three months. Nonetheless, the average STLA price target of $10.64 indicates a 2.21% upside potential.