Stellantis’ (STLA) shares during early trading on Monday managed to withstand the pressure of yet another recall from the Franco-Italian automobile manufacturer. According to the U.S. auto regulator, the carmaker has been forced to issue a new recall of over 123,000 vehicles due to detached trim pieces on the driver and passenger windows.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest recall, announced on Saturday by the U.S. National Highway Traffic Safety Administration (NHTSA), comes just over a week after the carmaker also recalled almost 164,000 Jeep vehicles due to a similar issue on driver and passenger doors. Both recalls affect the same car models, the Jeep Wagoneer and Jeep Grand Wagoneer.

However, while the new recall affects the models made between 2022 and 2024, the previous one extended further to those with a 2025 manufacturing date. Both recalls were issued to avert the risk of a crash, should the trim come loose.

Stellantis’ shares were up more than 1% as of 6:14 a.m. EDT during pre-market trading on Monday.

Recalls Persist as Sales Slide and Tariffs Tighten

Meanwhile, the newest recall is only one of several reputation-bashing recalls Stellantis has had to issue in the U.S. this year. In a separate case this month, the carmaker pulled back about 54,000 vehicles over possibly faulty fuel pumps that could cause a crash.

Similarly, in July, the automaker recorded two different recalls. First, Stellantis recalled 121,390 vehicles due to a possible hazard from head restraints that were likely to not lock properly. Second, it initiated a recall query into about 299,000 vehicles after customers filed complaints about their faulty shifter cable bushings.

Furthermore, about a month earlier, Stellantis also flagged over 250,000 vehicles due to improperly sealed side curtain airbags, forcing it to issue a recall. The company, which has headquarters in both the Netherlands and the U.S., has also recorded several other recall events this year.

However, these recalls, which hurt Stellantis’ reputation, come at a time the carmaker is seeing sales decline in the U.S. During Q2 2025, Stellantis, overall, sold 309,976 vehicles, which is a 10% drop in sales from the same period in the prior year.

The fall comes amid a volatile auto industry tariff regine in the country. This is even as Stellantis only recently managed to achieve its first sales growth in Europe since February 2024.

Meanwhile, Stellantis on Monday revealed the appointment of its long-time executive, Joao Laranjo, as chief financial officer. Laranjo, who previous manned the company’s operations in Latin America, replaces Doug Ostermann.

Is STLA a Good Stock to Buy?

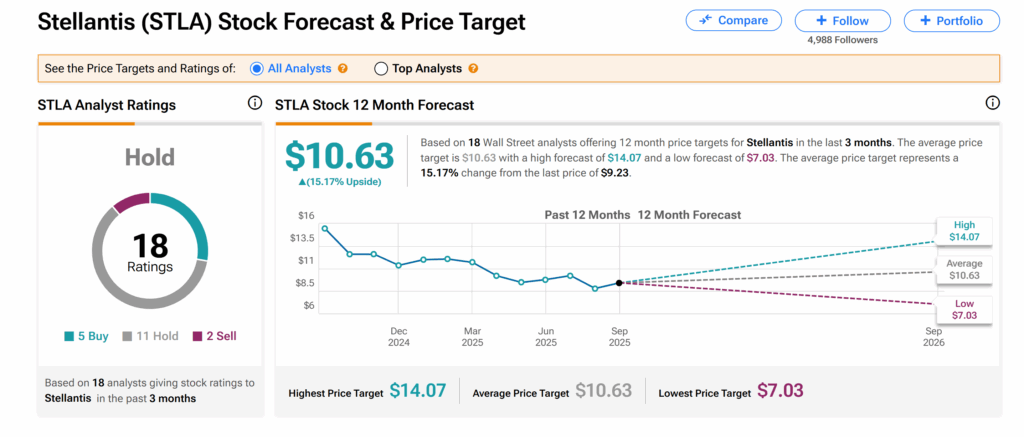

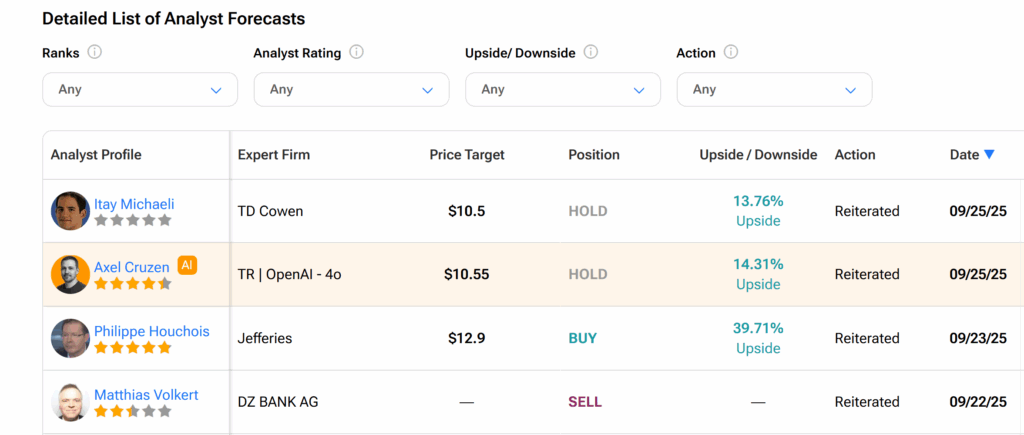

Turning to Wall Street, Stellantis’ shares have a Hold consensus rating, as seen on TipRanks. This is based on five Buys, 11 Holds, and two Sells assigned by 18 Wall Street analysts over the past three months.

However, the average STLA price target of $10.63 points to a 15.17% growth potential from the current level.