As its earnings report nears, Spotify Technology (NYSE:SPOT) plans to increase the price of its ad-free premium subscription plan to $10.99 from $9.99 per month, the Wall Street Journal reported. The music-streaming company is expected to make this announcement in the United States this week, with similar price increases coming soon in other countries.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Significantly, the music-streaming giant will be raising the premium plan’s price for the first time since its introduction in 2011. SPOT’s move to raise prices is aimed at bolstering its financial performance. Despite experiencing strong subscriber growth, Spotify is struggling to report a profit, partly due to rising content costs, a slowdown in advertising, and intense competition in the streaming industry.

It is worth highlighting that Spotify raised the price of its family plan, which allows up to six users, in various markets over a year ago.

Price Hike Era

Interestingly, several streaming companies have also increased their monthly prices recently. In January, Amazon Music raised the monthly subscription price to $10.99 from $9.99 in both the U.S. and U.K. markets. Also, Apple Music made a similar move last year.

Moving on, video streaming platforms, including Peacock and Disney+, have also upped prices in recent months. Furthermore, Netflix (NFLX) recently scrapped its low-priced ad-free plan for $9.99 per month in the U.S. and UK.

SPOT Upcoming Q2 Results

Spotify is scheduled to release its Q2 earnings on July 25, before the market opens. The Street expects SPOT to report a loss per share of $0.7, compared with a loss of $0.85 reported in the same period last year.

Is SPOT a Good Stock to Buy?

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 17 Buys and seven Holds. The average Spotify price target of $171.75 implies a limited upside potential of 0.02% from the current level. The stock has soared about 110% so far in 2023.

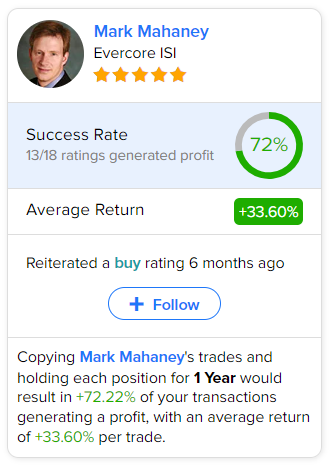

As per TipRanks’ data, the most accurate and profitable analyst for SPOT is Evercore ISI analyst Mark Mahaney. Copying the analyst’s trades on this stock and holding each position for one year would have resulted in 72% of your transactions generating a profit, with an impressive average return of 33.6% per trade.