Netflix (NASDAQ:NFLX) has pulled the plug on its low-priced ad-free plan, priced at $9.99 per month for new or rejoining members in the U.S. and UK. This move comes after the company previously implemented the change in Canada. The streaming giant’s strategy seems to be pushing more subscribers towards its ad-supported tier, which was introduced in November 2022.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company’s recent action leaves subscribers with two options: a more affordable plan with ads priced at $6.99 per month or a premium ad-free plan at $15.49 per month. The move is likely to help the company boost its revenues.

The success of NFLX’s ad-supported plans is evident, as they generate higher revenue per member compared to the basic and standard plans. With ad-supported plans, the company not only earns money from the monthly subscription fee but also benefits from ad revenue, contributing to its overall profitability.

The Password-Sharing Crackdown Continues

Netflix’s efforts to curb password sharing have indeed contributed to its robust subscriber growth. In the second quarter of 2023, the company added 5.9 million subscribers, a significant increase compared to the one million customers lost in the same quarter of the previous year.

Remarkably, the company is expanding its crackdown on account-sharing practices to other regions as well. Recently, the company announced that users in India will no longer be able to share passwords with individuals outside their households.

What is Netflix Stock’s Prediction?

NFLX stock has gained over 60% so far in 2023. Investors have cheered Netflix’s initiatives to expand its customer base and boost its revenue with the ad-supported plan. Additionally, the company’s commitment to delivering a robust content slate has contributed to higher customer engagement and overall satisfaction.

Overall, Wall Street is cautiously optimistic about NFLX stock. It has a Moderate Buy consensus rating based on 17 Buys, nine Holds, and two Sells. Meanwhile, the average price target of $446.41 implies 6.5% downside potential from the current level.

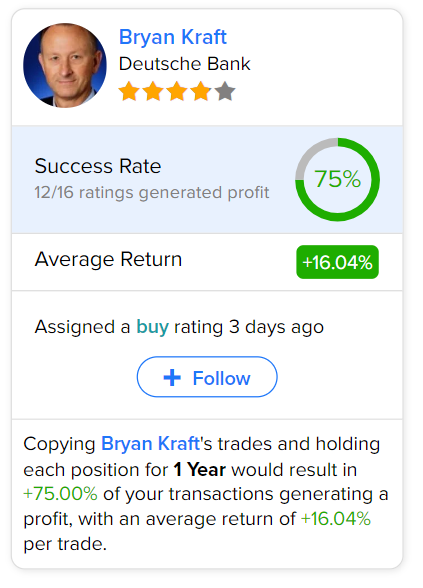

As per TipRanks data, the most accurate and profitable analyst for NFLX is Deutsche Bank analyst Bryan Kraft. Copying the analyst’s trades on this stock and holding each position for one year could result in 75% of your transactions generating a profit, with an impressive average return of 16.04% per trade.