Last Updated: 3:00PM EST

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

First Republic Bank (NYSE:FRC) has lost almost half of its value so far in today’s trading session. This can be attributed to the bank’s earnings report, which showed a staggering $72 billion in net deposit outflows for the quarter. It’s a critical time for the bank, and all eyes are on the White House, the Federal Reserve, and the Treasury as they weigh their options to rescue First Republic through an “open bank” strategy, as reported by CNBC.

One potential solution being discussed involves the creation of a special-purpose entity. This entity, backed by the banks that supported First Republic with $30 billion in deposits just a month ago, would buy the bank’s “underwater” loans at a higher value than their current worth. CNBC’s David Faber, citing familiar sources, suggests that if this plan is implemented, First Republic may then have the opportunity to raise new equity.

Furthermore, First Republic is considering selling up to $100 billion worth of mortgages and long-dated securities in order to improve its asset-to-liability mismatch. According to Bloomberg, warrants or preferred shares may be offered in order to incentivize buying the assets above market value.

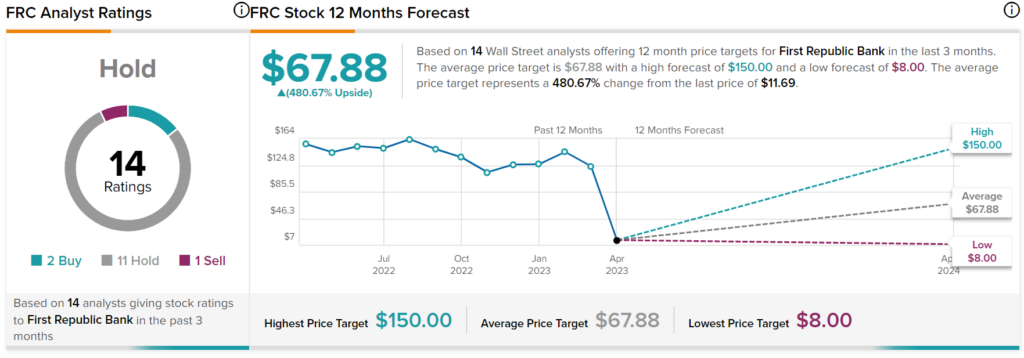

Despite FRC’s share plunge, Wall Street still maintains a high average price target. Indeed, analysts have a consensus price target of $67.88 on FRC stock, implying over 480% upside potential, as indicated by the graphic above.