Shares of First Republic Bank (NYSE:FRC) nosedived in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2023. Previously, it was up over 12% in Monday’s trading but gave back much of those gains after hours. Earnings per share came in at $1.23, which beat analysts’ consensus estimate of $0.92 per share. Sales decreased by 16% year-over-year, with revenue hitting $1.21 billion. This beat analysts’ expectations of $1.13 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

First Republic Bank offered up its share of ups and downs to investors. The bank brought in $923 million outright in interest income, but this was down 19.4% against this time last year. Its book value per share climbed nicely by 10.4%, up to $76.97. Its net interest margin came in at 1.77%, which faltered against the 2.45% seen in the previous quarter. Its efficiency ratio was up, however, coming in at 70.4% against the previous quarter’s 63.9%.

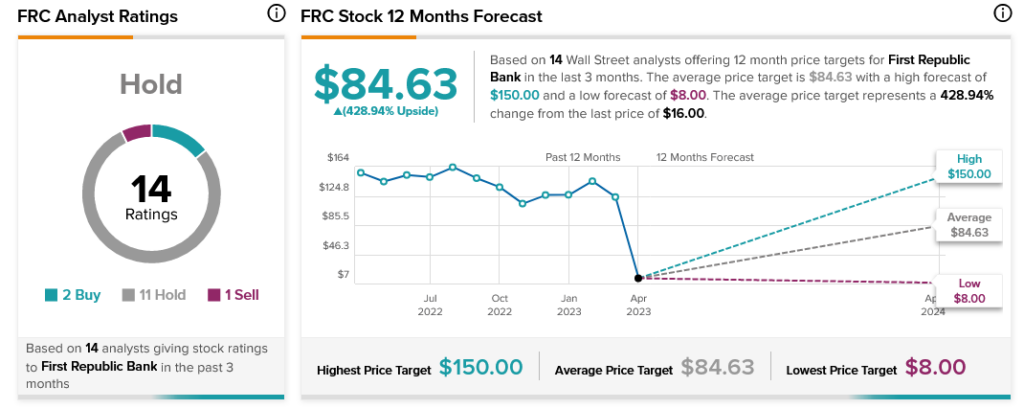

Overall, Wall Street has a consensus price target of $84.63 on First Republic Bank, implying 428.94% upside potential, as indicated by the graphic above.