SoFi Technologies (NASDAQ:SOFI) has its positive points, but it’s not a perfect fintech (financial technology) pick by any means. There are potential red flags for SoFi, and the company needs to shift its focus to business segments that aren’t too sensitive to student loan policy and interest rates. Therefore, I am neutral on SOFI stock for 2024.

SoFi Technologies is a firm that offers an interesting alternative to traditional banks. The company generates revenue from its lending business, which includes helping people refinance their student loans.

As we’ll delve into shortly, there are specific reasons why SoFi should avoid excessive reliance on its lending business and focus on other revenue sources. Otherwise, SOFI stock could lose value over the long term.

SoFi, Student Loan Debt, and Fed Policy

It’s no secret that the Biden administration favors federal student loan debt forgiveness. The administration has enacted policy measures to eliminate some or even all debt for many student loan borrowers.

In a recent example of this, the Biden administration canceled $1.2 billion worth of collective debt for 153,000 student loan borrowers. The point here isn’t to debate the merits of the student loan debt forgiveness policy, but only to observe that the current administration will likely continue to pursue this type of policy.

This is a reason why SoFi Technologies needs to steer away from its lending business sooner rather than later. An additional factor is the possibility that the Federal Reserve could maintain higher interest rates for an extended period, contrary to market expectations.

Federal Reserve Chairman Jerome Powell stated outright that a March interest-rate cut “is not the most likely or base case.” That’s potentially problematic for lenders like SoFi Technologies, as persistently elevated interest rates can inhibit borrowing and lending activity.

I agree 100% with Keefe, Bruyette, and Woods analyst Michael Perito, who seems concerned about SoFi Technologies’ ability to derive revenue from its lending segment. According to Barron’s, Perito “believes SoFi is likely to find it increasingly difficult to increase market share” in lending and “will need to continue diversifying its asset base beyond personal loans.”

With that in mind, Perito assigned SOFI stock an Underperform rating and a price target of $6.50, which implies some downside from the current share price. Hopefully, SoFi Technologies’ management will heed Perito’s cautionary note and focus more on the company’s Financial Services and Technology segments.

New Offering Could Signal Trouble for SoFi Technologies

SoFi Technologies is tumbling today, as it was down 11% by 11:00 a.m. Eastern Time. Granted, the stock market was mostly in the red, but clearly, something unsettling was going on with SoFi Technologies.

It wasn’t difficult to figure out what was going on. In a press release, SoFi Technologies disclosed that the company intends to offer $750 million worth of convertible senior notes with maturity dates in 2029.

The easiest way to interpret this is to think of senior notes as corporate bonds. SoFi Technologies is basically selling $750 million worth of bonds—and maybe even more than that, since the company may end up selling “up to an additional $112.5 million” worth of senior notes.

I scoured through the press release multiple times but didn’t see anything from SoFi Technologies specifying how much interest the company will have to pay on all of those senior notes. This is problematic, as the market doesn’t like uncertainty.

Not only will SoFi Technologies undoubtedly have to pay back those senior notes with interest, but it’s bothersome that the company feels the need to borrow so much money. I won’t immediately assume that SoFi Technologies is in deep financial trouble, but I can see why the market would choose to sell SOFI stock today.

At least, SoFi Technologies didn’t print and sell a whole bunch of common stock shares. That would be worse, as it would dilute the value of the existing shares. Still, investors should hope that SoFi Technologies doesn’t make a regular habit of borrowing money through bond sales.

Is SOFI Stock a Buy?

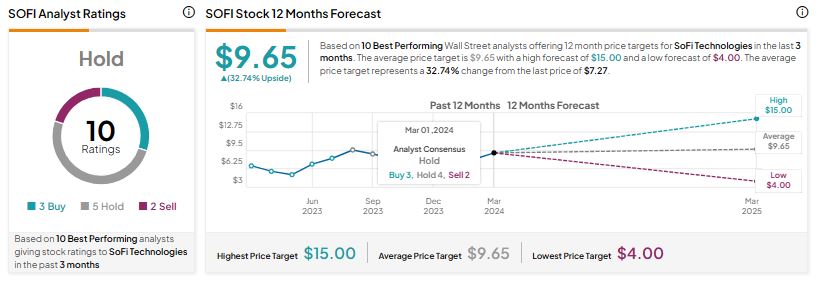

On TipRanks, SOFI comes in as a Hold based on four Buys, eight Holds, and four Sell ratings assigned by analysts in the past three months. The average SoFi Technologies price target is $9.65, implying about 33% upside potential.

Conclusion: Should You Consider SOFI Stock?

All in all, it’s not a hopeless situation for SoFi Technologies. Going forward, investors should insist that SoFi Technologies shift away from its lending business and instead rely on other revenue sources.

Nevertheless, the shareholders may be concerned because SoFi Technologies plans to potentially borrow a very large sum of money through senior-note sales. With all of that in mind, I am staying neutral and am not currently considering SOFI stock.