Snap (SNAP) shares are rallying in pre-market trading, up 15%, following a strong Q3 earnings beat and news of a strategic deal with Perplexity AI. The social media company reported an adjusted loss of $0.06 per share, narrower than analysts’ expected loss of $0.12 per share and the prior year period’s loss of $0.08 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Similarly, revenue rose 9.8% year-over-year to $1.51 billion, surpassing the consensus estimate of $1.49 billion.

Details of Snap’s Q3 Results and Outlook

Snap’s Daily Active Users (DAUs) of 477 million exceeded expectations. Its global average revenue per user (ARPU) of $3.16 also beat estimates. Moreover, the company announced a $500 million stock buyback program.

Looking ahead, Snap guided for Q4 revenue between $1.68 billion and $1.71 billion, implying year-over-year growth of 8% to 10%, slightly above Wall Street’s forecast of $1.69 billion.

Perplexity Deal Brings AI-Powered Answers to Snapchat

Snap announced a strategic partnership with AI startup Perplexity AI, which will integrate its AI answer engine directly into Snapchat. The companies said this integration will give Snap’s nearly one billion monthly active users access to real-time answers from credible sources and the ability to explore new topics within the app.

Under the deal, Perplexity will pay Snap $400 million over one year through a mix of cash and equity, contingent on global rollout. Revenue from the partnership is expected to begin in 2026.

Snap CEO Evan Spiegel said Perplexity’s chatbot will appear by default in Snapchat’s chat inbox, with Perplexity controlling its replies. Snap will not run ads on those responses, but the integration could help Perplexity gain more subscribers. Spiegel added that Snapchat aims to use its chat platform to distribute AI agents, and users will still have access to Snap’s own My AI chatbot for real-time, sourced answers.

Snap Faces Shifting Policy Landscape

Snap cautioned investors that new global laws and regulations are starting to affect technology companies. Snap cited Australia’s proposed law setting a minimum social media age of 16, which could reduce user engagement. It also warned that upcoming age verification measures by Apple (AAPL) and Google (GOOGL) could further impact user numbers.

Despite these challenges, Snap reiterated its goal of reaching one billion monthly active users, though it expects daily active users to decline in the fourth quarter due to internal and external factors affecting some regions more than others.

Is SNAP Stock a Good Buy?

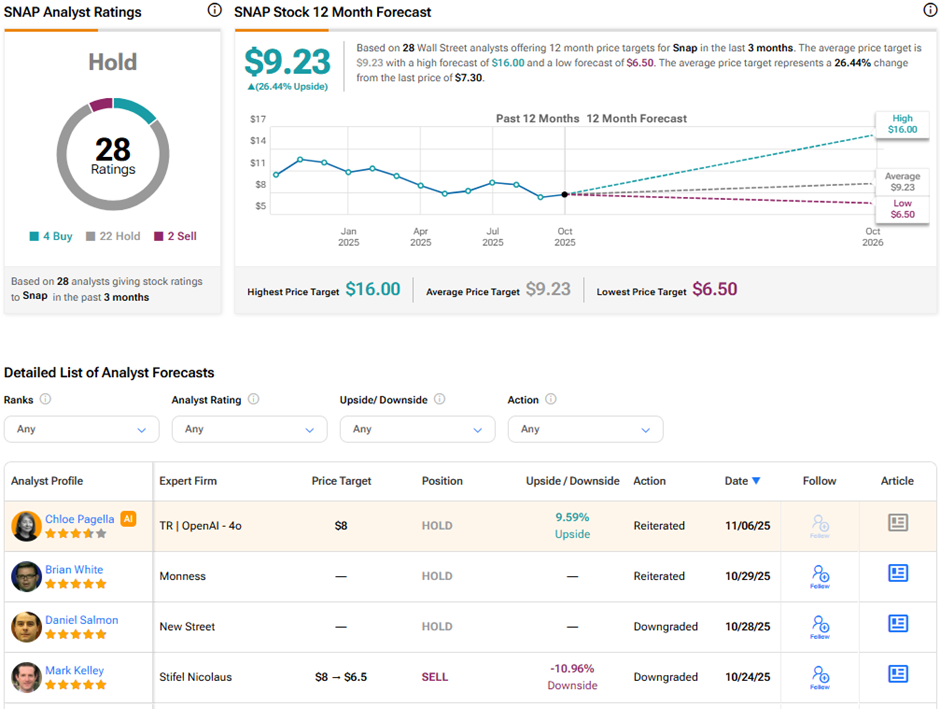

On TipRanks, SNAP stock has a Hold consensus rating based on four Buys, 22 Holds, and two Sell ratings. The average Snap price target of $9.23 implies 26.4% upside potential from current levels. Year-to-date, SNAP stock has lost 32.2%.