Skyworks Solutions delivered impressive 4Q results as earnings of $1.85 crushed analysts’ estimates of $1.52 and rose about 21.7% year-over-year. The semiconductor company’s revenues of $956.8 million jumped 15.6% year-over-year and came ahead of the Street consensus of $842.4 million.

Skyworks’ (SWKS) CEO Liam K. Griffin said “With 5G technology launches now well under way, we are ramping our innovative Sky5 solutions in a rapidly expanding set of end markets, from mobile to IoT, automotive and wireless infrastructure.” He added that “Increased demand for reliable, ultra-fast wireless connections in our homes, businesses, schools and medical facilities is driving strong momentum throughout our product portfolio, positioning Skyworks for continued growth.”

For the December-ending quarter (1Q 2021), Skyworks anticipates revenue in the range of $1.04 billion – $1.07 billion, higher than the consensus estimate of $935.4 million. The company expects 1Q earnings to be $2.06 per share, compared with the $1.80 per share anticipated by analysts . Skyworks’ CFO Kris Sennesael said “We expect double-digit sequential revenue and earnings growth in the December quarter, fueled by content gains and product ramps across multiple 5G-enabled smartphone platforms and increased demand across our broad markets portfolio.”

As for fiscal 2021, Skyworks Solutions foresees better-than-expected earnings of $6.13, compared with the consensus estimate of $5.81. FY2021 revenue is expected to land $3.356 billion, versus analysts’ estimates of $3.25 billion. (See SWKS stock analysis on TipRanks).

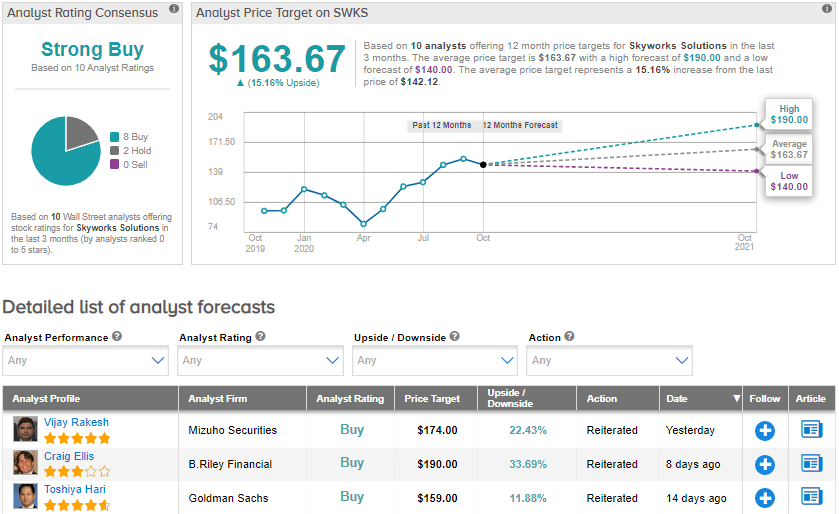

Following the results, Mizuho Securities analyst Vijay Rakesh raised the price target to $174 (22.4% upside potential) from $170 and maintained a Buy rating on SWKS stock. The analyst said that “SWKS continues to gain 5G handset traction, and is supply-constrained through December, along with seeing higher-margin Broad Markets strength in IoT [Internet of Things] and Automotive.”

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 8 Buys and 2 Holds. The average price target of $163.67 implies upside potential of about 15.2% to current levels. Shares are up by 17.6% year-to-date.

Related News:

Magellan Tops 3Q Profit As Refined Products Demand Improves

Twitter’s Ad Revenues Drive 3Q Sales Beat

Clorox Hikes 2021 Guidance Due To Cleaning Bonanza; Shares Rise 4%