Shares of Clorox are climbing 3.7% in Monday’s pre-market session after the bleach maker bumped up its full-year sales and profit projections as the pandemic-led cleaning need fuels demand for its products.

Clorox (CLX) now expects 2021 fiscal full-year sales to increase between 5% and 9% versus flat to low single-digit growth in a previous forecast. The maker of bleaches, wipes and cleaning products sees stronger sales results over the balance of the 2021 fiscal year, including double-digit sales growth in the second quarter.

At the same time though, Clorox also anticipates a sales deceleration in the back half of fiscal 2021 from the double-digit growth level recorded during the peak outbreak period of the coronavirus pandemic back in March. However, 2021 back-half sales results are still expected to be “significantly stronger” relative to pre-pandemic levels, the company said.

Diluted EPS in fiscal year 2021 is forecasted to increase between 5% and 8%, or $7.70 to $7.95, up from prior guidance of mid-single-digit growth or a decline.

The upbeat guidance update comes as Clorox reported that sales rose 27% to $1.92 billion in the three months ended Sept. 30, driven by double-digit growth in eight of 10 business units due to the COVID-19 impact and people spending more time at home. Analysts had been looking for $1.76 billion in the fiscal first quarter. Earnings more than doubled to $415 million, or $3.22 per share, and included a one-time, non-cash gain from the remeasurement of the company’s previously held investment in its Saudi joint venture.

“We delivered another quarter of outstanding results to have a strong start to the fiscal year, with broad-based strength across our portfolio, driving double-digit sales growth in all reportable segments,” said Clorox CEO Linda Rendle. “At a time of global uncertainty, these results speak to the strength of our brands. Moving forward, we’ll drive our momentum by leaning into our IGNITE strategy. We’ll invest strongly in superior brand experiences and strategic growth initiatives in support of our ambition of accelerating long-term profitable growth for the company.”

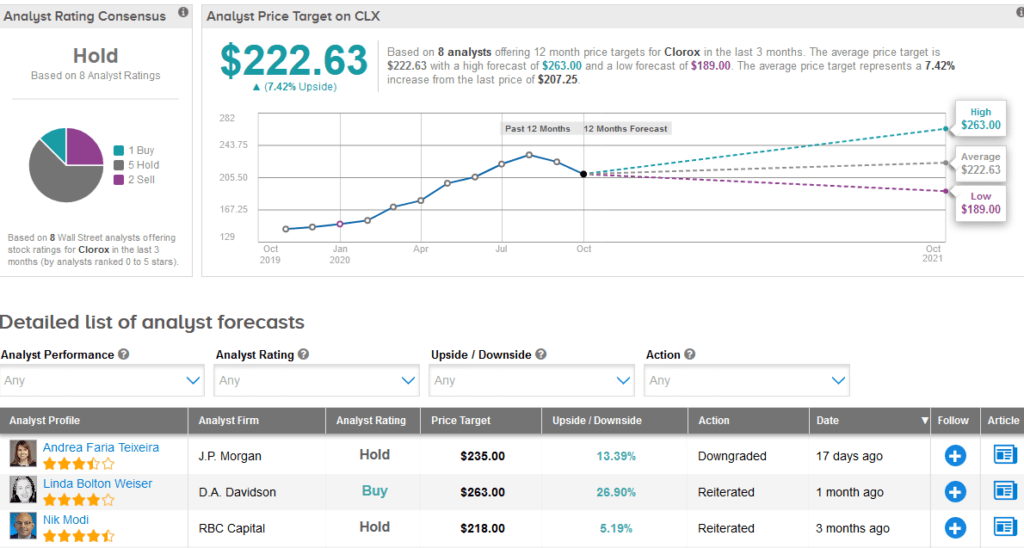

With Clorox shares up 35% so far this year driven by ample demand for its disinfecting products during the coronavirus pandemic, the majority of analysts have been sidelined on the stock for now. The Hold consensus shows 5 Holds and 2 Sells versus 1 Buy. Meanwhile, the $222.63 average price target implies 7.4% upside potential in the coming 12 months.

DA Davidson analyst Linda Bolton Weiser recently lowered the stock’s price target to $263 from $269 but maintained a Buy rating, citing data showing that Clorox’s tracked channel point of sales in September recorded a deceleration from August and July levels. The analyst had expected Clorox to post Q1 EPS of $2.06. (See Clorox stock analysis on TipRanks).

Related News:

Skechers Falls 9% Despite Earnings Beat, Street Stays Bullish

Dunkin’ To Be Taken Private By Inspire Brands In $8.8B Deal

Starbucks Tops 4Q Estimates, Sees Strong Global Comps In FY21