Shares in oil giant Shell (SHEL) were flowing well today as it reported a stronger performance in its oil and gas trading activities. It even prompted some analysts to suggest that it could be another trigger for the group to shed its primary stock market listing in London and head to New York.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Higher Trading

In an update ahead of its Q3 results on October 30, the group said that trading in its integrated gas division is set to have been significantly higher during the period than its previous quarter.

Shell reported production guidance of 910,000 to 950,000 barrels of oil equivalent per day of gas for the latest quarter. The company also lifted its production guidance for the amount of liquefied natural gas (LNG) it would produce over the quarter.

On Tuesday, it guided towards a range of 7 million to 7.4 million metric tonnes, compared with a previous prediction of between 6.7 million and 7.3 million.

The group said it expects to deliver adjusted earnings of around 4.3 billion US dollars (£3.2 billion) for the third quarter.

However, it wasn’t all good news from Shell as it revealed it has taken a $600 million hit as a result of cancelling a major biofuels project in Rotterdam, Netherlands.

Meanwhile, it also highlighted that it would face a knock to earnings of between $200 million and $400 million from its Brazilian operations.

Big Bet

Analysts said that Shell was being rewarded for its “big bet” on natural gas. “It continues to yield positive results,” said Russ Mould, investment director at AJ Bell. “Shell delivered a steady-as-she-goes assessment of trading. While this would not ordinarily be cause for too much excitement, to achieve an outcome broadly in-line with the second quarter despite a material decline in oil prices is a decent outcome.”

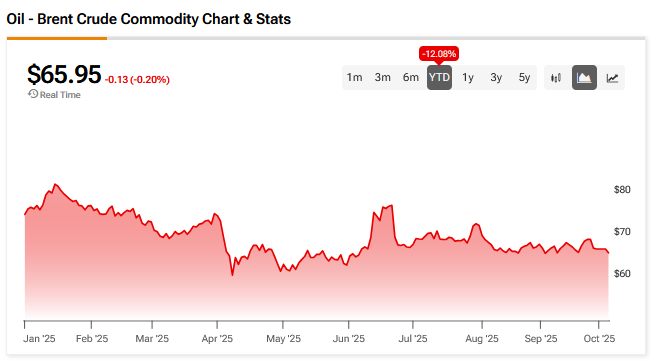

Indeed, the Brent Crude oil price has dropped by around 12% over the last 12 months hit by economic and geopolitical fears. – see below:

Rival stocks such as BP (BP) have suffered badly in 2025 leading to speculation that Shell could launch a takeover bid. That talk seems to have quietened down but Mould believes that Shell is looking at other ways to boost its business and current $213 billion valuation.

“The fear in London is this might eventually involve a shift in its primary stock listing to New York which would be a devastating blow for the UK market,” said Mould.

Is SHEL a Good Stock to Buy Now?

On TipRanks, SHEL has a Moderate Buy consensus based on 5 Buy and 4 Hold ratings. Its highest price target is $82. SHEL stock’s consensus price target is $77.86, implying a 4.83% upside.