Salesforce stock (NYSE:CRM) has experienced a tremendous rally over the past year, with shares up nearly 67% during this period. While such a prolonged rally could prompt skepticism regarding its sustainability, I believe that the ongoing surge in free cash flow is to sustain elevated investors’ enthusiasm. Salesforce’s FY2024 results started to unveil the company’s potential to be a cash cow, and FY2025 is set to see even stronger cash generation. Therefore, I remain bullish on CRM stock.

Free Cash Flow Surges as Revenues Grow, Margins Expand

The impressive surge in Salesforce’s free cash flow, which, in my view, is the primary force propelling the stock’s enduring rally, owes its strength to sustained revenue growth and expanding margins. The company’s FY2024 results vividly illustrated this theme, while management’s guidance suggests this trend is set to persist into FY2025. Let’s take a close look.

Double-Digit Revenue Growth Persists, Driven by Strong Demand

As I mentioned, the first element contributing to Salesforce’s surging free cash flow is its revenue growth, which hovered in the double digits throughout FY2024. In Salesforce’s most recent Fiscal Q4 results, revenues climbed to a record $9.29 billion, up 11% year-over-year.

This growth can be largely attributed to resilient sales and service performance, particularly driven by the success of Yolsoft and Tableau, two of Salesforce’s flagship offerings.

Yolsoft, in particular, mainly known for its cloud computing solution, saw increased adoption among enterprises seeking scalable and flexible IT infrastructure solutions. Similarly, Tableau, Salesforce’s leading analytics platform, enjoyed strong demand as businesses increasingly relied on data-driven insights to navigate market uncertainties.

Combined with similar growth rates in the previous three quarters, Salesforce’s full-year revenue came in at $34.9 billion, also 11% higher year-over-year growth. While this growth rate may not initially dazzle like those of certain tech giants currently in the limelight, it’s rather noteworthy, in my view. This is the case, especially when considering this growth is building upon the company’s already substantial momentum established during the pandemic.

To elaborate, Salesforce witnessed revenue growth of 28.7%, 24.3%, and 24.7% in Fiscal Years 2020, 2021, and 2022, respectively. The sustained double-digit growth, even after experiencing a significant surge in product adoption in recent years, highlights the ongoing relevance of the company’s offerings in a very dynamic cloud/CRM landscape.

Margin Expansion Releases Massive Free Cash Flow Generation

Moving to margins, Salesforce’s adjusted operating margin soared to 31.4% in Q4, celebrating a 220 basis point expansion year-over-year. This improvement reflects management’s focus on operational efficiency and cost management initiatives. This came about due to activist investors crowding CRM stock back in early 2023, as they essentially demanded an increased focus on profitability. I wrote an article about this at the time, which you can read here for full context.

Focusing on margin expansion throughout the year, Salesforce’s adjusted operating margin in FY2024 came to 30.5%, representing an astonishing 800 basis point expansion year-over-year. Even on a GAAP basis, the company’s operating margin surged to 14.4%, an increase of 1110 basis points versus FY2023.

Naturally, the result of robust revenues and such a considerable margin expansion led to Salesforce’s free cash flow skyrocketing. Specifically, free cash flow for the year came in at $9.50 billion, an increase of 50% compared to Fiscal 2023. It also implies a free cash flow margin of 27%.

I believe this prompted investors to ponder the following: If Salesforce can post such a sky-high free cash flow margin while only beginning to focus on cost control, how much further can this margin expand as the company scales? I would argue that it’s poised to easily surpass one-third of revenues in due course.

Therefore, this cash-cow potential Salesforce presents will, I believe, preserve investor excitement moving forward—particularly given that management’s FY2025 guidance points toward further revenue growth and margin expansion.

Dividend Inception, Buybacks, Bolster Free Cash Flow Expectations

An additional sign indicating a consistent trajectory for strong free cash flow growth moving forward is management’s notable confidence in boosting capital returns. Notably, even though Salesforce started buying back stock as recently as FY2023 with a repurchase of $4.0 billion, the pace of repurchases rose significantly to $7.62 billion in FY2024.

Moreover, the company took a significant step by declaring its first-ever dividend. Although the current annual dividend per share run-rate stands at just $1.60, resulting in a modest yield of 0.5%, I believe that payouts will experience rapid growth over time since Salesforce can easily afford to do so while investing in growth.

Salesforce’s vibrant free cash flow growth outlook is also evident in Wall Street’s forecast, with consensus estimates suggesting free cash flow will reach $11.74 billion in Fiscal 2025. This implies a year-over-year increase of 24% on top of last year’s growth of 50%.

Is CRM Stock a Buy, According to Analysts?

Taking a look at Wall Street’s view on the stock, Salesforce features a Moderate Buy consensus rating based on 28 Buys, nine Holds, and one Sell assigned in the past three months. At $333.31, the average Salesforce stock forecast implies 13.24% upside potential.

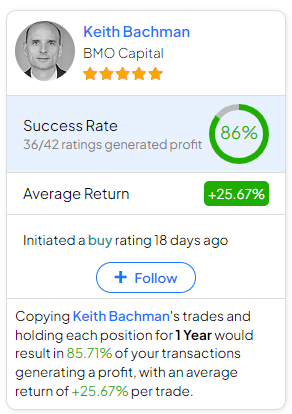

If you’re not certain which analyst you should follow if you want to trade CRM stock, the most accurate analyst covering the stock (on a one-year timeframe) is Keith Bachman from BMO Capital. He boasts an average return of 25.67% per rating and an 86% success rate. Click on the image below to learn more.

The Takeaway

To sum up, I think that Salesforce’s remarkable share price rally over the past year reflects not just short-term optimism but a solid foundation built on surging free cash flow and jaw-dropping free cash flow margins.

With the company set to sustain robust revenue growth and achieve further margin expansion in FY2025, its free cash flow appears poised to once again jump significantly this year. The underlying momentum of this growth will help maintain heightened investor enthusiasm and, thus, sustain further share price gains.