Salesforce shares (CRM) jumped nearly 6.5% in pre-market trading after the company released a long-term revenue forecast and pointed to growth in its AI platform, Agentforce. The announcement temporarily lifted sentiment after a tough year for the stock, although analysts remain cautious about the company’s ability to compete in the fast-moving AI space.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The move comes after a 29% slide in Salesforce’s stock this year, driven by investor concerns that new AI-native competitors could eat into its market share in customer relationship management software. With this latest forecast, Salesforce is aiming to convince the market it still has a leading role to play in the next phase of enterprise software.

Salesforce Sets Long-Term Growth Target

Salesforce said Wednesday that it expects to generate more than $60 billion in revenue in fiscal year 2030. The figure tops analyst expectations of $59.66 billion, and indicates a shift toward more optimistic long-term positioning.

The guidance helped lift the stock 5.8% to $250.40 in pre-market trading Thursday. This bounce followed a prolonged slide this year as concerns over slowing growth and rising competition weighed on investor sentiment. The company’s forecast signals confidence in its ability to accelerate performance over the next five years.

Agentforce Adoption Gains Traction

The company also disclosed that its agentic AI platform, Agentforce, brought in $440 million in annual recurring revenue in the Fiscal second quarter. More than 12,000 customers are using the platform, which automates tasks across sales, marketing, and service.

“We’re leading the next great transformation in business—the era of the Agentic Enterprise—where AI elevates human potential and accelerates growth,” said Marc Benioff, CEO of Salesforce. He positioned Agentforce as a foundational tool in this shift, linking it directly to the company’s long-term strategy and optimism about AI adoption in business.

Analysts Question AI Execution

Not everyone is convinced that Salesforce can deliver on its 2030 goal. Gil Luria, a 5-star analyst at D.A. Davidson, described the revenue target as “aspirational,” noting that it implies Salesforce would need to accelerate organic growth back above 10% annually. This would represent a shift from the company’s recent growth trajectory.

“While we recognize that Salesforce’s pace of platform innovation has been accelerating over the last year, there seems to still be a disconnect between customer experiences and management’s commentary,” Luria wrote in a research note. “We also heard from customers that Agentforce implementations have had limited success at scale, partially due to customer related technology bottlenecks and issues implementing AI to achieve desired business outcomes.”

Key Takeaway

Salesforce is attempting to reframe its position in the AI race with a stronger revenue forecast and early traction for its agentic AI platform. The stock’s rally shows the market is receptive, but delivery will be key.

There is still skepticism about whether Salesforce can scale its AI tools effectively and keep pace with newer competitors. For now, investors are cautiously optimistic, but many will wait to see stronger proof that Agentforce can move from early adoption to enterprise impact.

Is Salesforce a Good Stock to Buy?

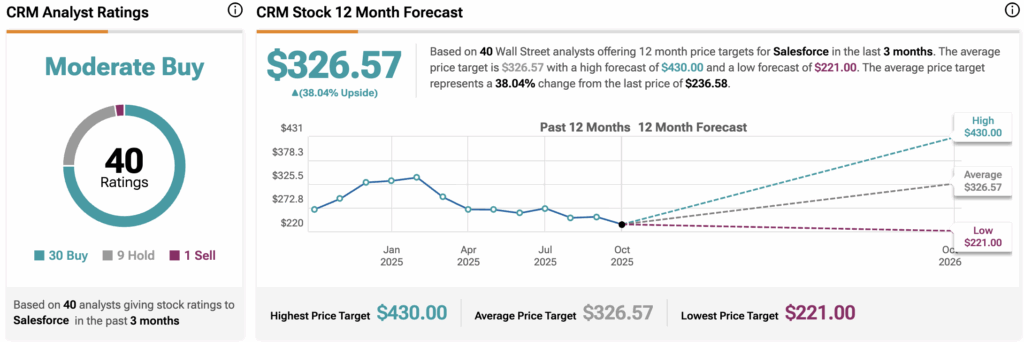

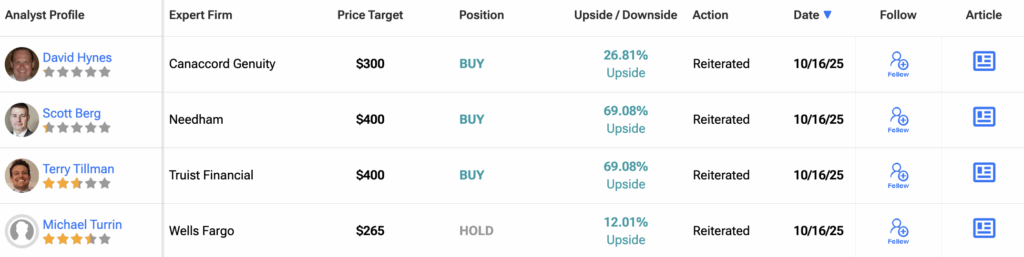

Wall Street remains broadly positive on Salesforce following the Agentforce 360 launch. Based on 38 recent analyst ratings, the stock holds a “Moderate Buy” consensus, with 29 Buys, eight Holds, and one Sell recommendation.

The average 12-month CRM price target sits at $326.57, implying 38% upside from Friday’s closing price.