Cloud service provider Salesforce (NYSE:CRM) has attracted a fifth activist investor recently. This time, Dan Loeb’s Third Point LLC has taken a stake in the company. The amount of investment and intention remain unknown at this point in time. Third Point is known for making strategic changes in underperforming companies that have room for improvement, as well as pushing for board seats. Remarkably, Dan Loeb’s investment timing may have something to do with Salesforce’s board nomination window, which opens on February 12 and closes on March 14.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The other two activist investors with stakes in Salesforce are Paul Singer Elliott Management, which took a stake in January 2023, and Jeff Smith’s Starboard Value, which took a stake in October 2022. Also, Jeff Ubben‘s ValueAct Capital Partners LP and Inclusive Capital took stakes in Salesforce last year.

Salesforce is facing a slew of issues, just like other technology stocks. The high demand for tech-related services during the pandemic forced software companies to hire disproportionately. Now, owing to slowing demand and macro challenges, Salesforce has announced a 10% reduction in the workforce and also seeks to shed unwanted office space to control costs. The company is also witnessing a top-management shuffle, leading to more organizational challenges.

Will Salesforce Continue to Grow?

Despite the above-mentioned problems, Salesforce has outperformed analysts’ expectations in the last several quarters. This means that the company has a stable business and is able to perform in spite of the pressures.

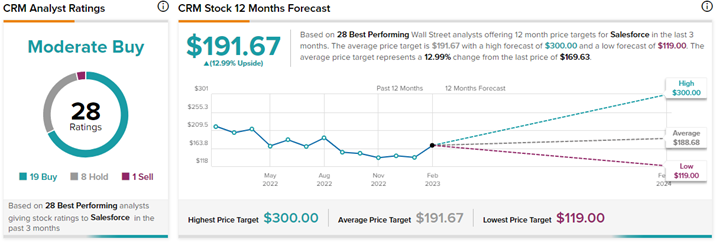

Analysts are currently split on the stock’s trajectory. On TipRanks, CRM has a Moderate Buy consensus rating based on 19 Buys, eight Holds, and one Sell rating. The average Salesforce price target of $191.67 implies a nearly 13% upside potential from current levels. Meanwhile, CRM stock has gained 25.9% so far this year versus losing 23.6% in the past year.