Data giant S&P Global Inc. has agreed to acquire the information and analytics company IHS Markit for $44 billion, including $4.8 billion debt. The buyout news pushed up the stocks of both, S&P Global and IHS Markit, by about 3% and 7.4% on Monday.

Per the terms of the deal, “each share of IHS Markit common stock will be exchanged for a fixed ratio of 0.2838 shares of S&P Global common stock.” After the completion of the deal, which is expected to close in the second half of 2021, the current S&P Global (SPGI) shareholders will hold about 67.75% of the combined company, while IHS Markit shareholders will own approximately 32.25%.

Furthermore, the deal is expected to generate annual revenue and cost synergies of $350 million and $480 million, respectively, by the end of the second full year post-closing of the merger.

IHS Markit’s (INFO) CEO Lance Uggla said “This transaction is a win for both IHS Markit and S&P Global as we leverage our respective strengths in information, data science, research and benchmarks.” Meanwhile, S&P Global’s CEO Douglas Peterson said “This merger increases scale while rounding out our combined capabilities, and accelerates and amplifies our ability to deliver customers the essential intelligence needed to make decisions with conviction.”

Peterson added “We are confident that the strengths of S&P Global and IHS Markit will enable meaningful growth and create attractive value for all stakeholders.” (See SPGI stock analysis on TipRanks)

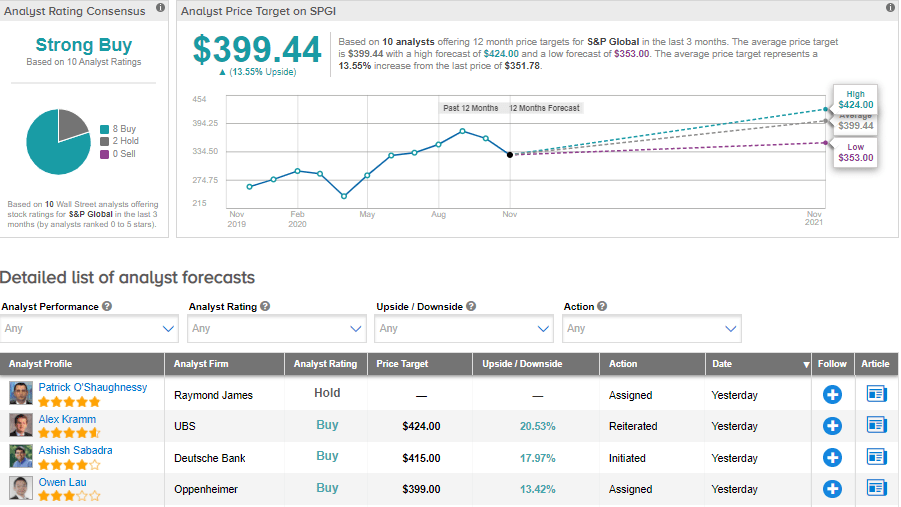

Following the merger news, Oppenheimer analyst Owen Lau maintained a Buy rating and a price target of $399 (13.4% upside potential) on SPGI. He said “With a more diversified portfolio of assets, increased recurring revenue (76%) and potentially better than expected accretion, we believe the combined entity can command a higher earnings multiple longer term.”

Like Lau, most of the Street also has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 8 Buys and 2 Holds. The average price target stands at $399.44 and implies upside potential of about 13.6% to current levels. Shares have gained by 28.8% year-to-date.

Related News:

Aegon To Sell Eastern European Business For $993M; Street Sees 11% Downside

Exxon Withdraws Sale Of Bass Strait Assets In Australia – Report

Sage Therapeutics Inks $1.5 Billion Development Deal with Biogen; Mizuho Stays Sidelined