Video game developer Roblox Corporation (NYSE: RBLX) has reported weaker-than-expected results for the fourth quarter ended December 31, 2021, as the company failed to surpass estimates in terms of both revenue and earnings.

Following the results, shares of the company declined 15.3% to close at $62.10 in Tuesday’s extended trading session.

Revenue & Earnings

Roblox reported quarterly revenues of $568.8 million, up 83% from the same quarter last year. The increase in earnings can be attributed primarily to the 20% year-over-year growth witnessed in bookings to $770.1 million. However, the figure missed the consensus estimate of $772 million.

The company reported a loss per share of $0.25 for the quarter, narrower than the loss of $0.30 per share reported last year. Yet, the figure came in wider than the consensus estimate of a loss of $0.13 per share.

Other Operating Metrics

Roblox’s Average Daily Active Users (DAUs) at the end of the quarter stood at 49.5 million, up 33% year-over-year. Moreover, the hours engaged by users witnessed a 28% year-over-year rise to 10.8 billion. Average Bookings per DAU (ABPDAU) stood at $15.57.

The company’s net cash provided by operating activities at the end of the quarter stood at $122.2 million, compared to $179 million in the previous-year quarter. Free cash flow for the quarter stood at $77.3 million, down from the previous year’s figure of $118.6 million.

Management Commentary

The CEO of Roblox, David Baszucki, said, “With nearly 55 million daily active users, Roblox is increasingly an integral part of people’s lives. As we look ahead to 2022, we will continue to develop our technology to enable deeper forms of communication, immersion and expression on our platform.”

Stock Rating

Post the results, Benchmark Co. analyst reiterated a Sell rating on the stock with a price target of $70, which implies 4.5% downside potential from current levels.

The analyst was disappointed with the revenue, earnings, and key performance indicators missing estimates. Further, muted audience engagement does not bode well for the company.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 7 Buys, 2 Holds and 1 Sell. The average Roblox stock prediction of $103.89 implies that the stock has 41.7% upside potential from current levels. Shares have gained 5.5% over the past year.

Website Traffic

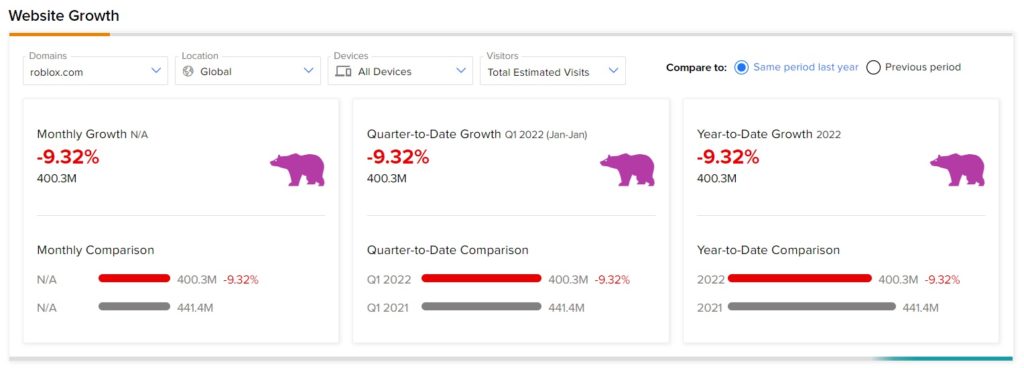

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Roblox’s performance this quarter.

According to the tool, year-to-date, the Roblox website traffic recorded a fall of 9.32%, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Restaurant Brands Q4 Revenue Nearly Doubles, Dividend Raised

Bank of America Sets Up New Online Payment Solution

Intel’s Mobileye to Launch Autonomous Shuttles in U.S. in 2024